Scope Ratings | The credit outlook for the integrated oil & gas sector has improved to stable from negative on improved price assumptions and companies’ decisive action to shore up their balance sheets last year. However, a weaker-than-expected economic recovery from the recession brought on by the Covid-19 pandemic and strategic challenges, such as tougher environmental regulation and peaking oil demand, are potential threats to credit quality. The main trends we expect integrated oil and gas companies (IOCs) to face in 2021 are:

•A significant recovery in oil and gas prices with Brent averaging around USD50/barrel and Dutch TTF at around EUR15/MWh; on average, we expect a moderate increase in refining and petrochemical margins.

•Following significant cuts in operating and capital expenditure in 2020, companies are more resilient to lower oil and gas prices than before the pandemic.

•IOCs in general have lost their appetite for heavy investment spending, while levels of shareholder remuneration will continue to vary across the sector.

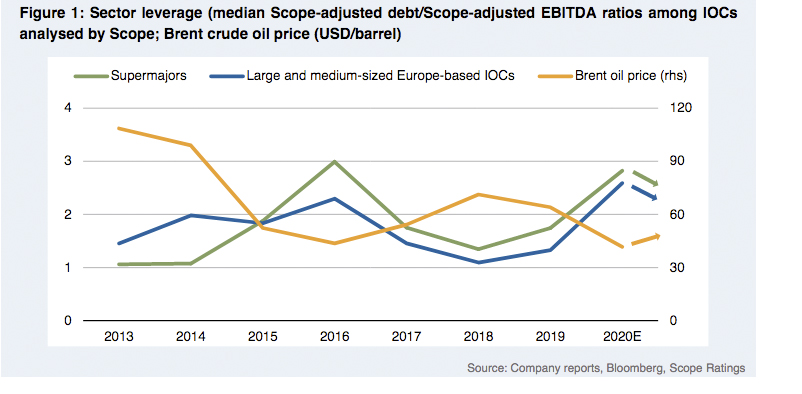

•Leverage ratios will improve, but a full recovery to pre-pandemic levels is unlikely before 2022-23.

•Unlike previous downturns, the industry experienced falling oil and gas prices last year and a significant drop in oil consumption and in refining margins –all at the same time. This combination of forces will transform the industry –from a tighter focus on low-cost and higher value-added activities to investments beyond legacy fossil-fuel businesses.

•The industry faces accelerating investor and regulatory pressures, not least with the change of government in the US, with the Biden administration returning to the Paris Agreement on climate change.

•More IOCs will set ambitious targets, leading to faster and deeper transformations of their operations, after many followed Repsol’s example in 2020 in announcing pledges to reduce net carbon emissions. The impact on credit quality will depend on the individual business and financial strategies.