“Growth is back, the labor market is improving, banks are healthier and debt sovereign yields are at record minimums,” Christine Lagarde’s institution points out.

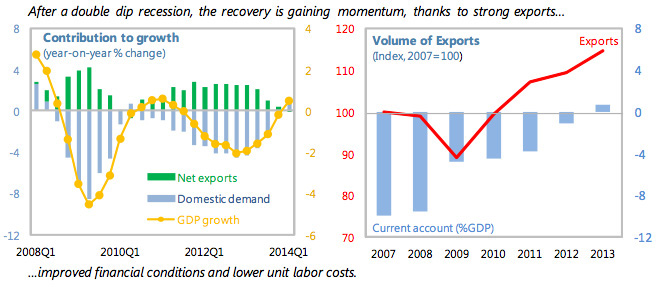

The Bank of Spain suggested this week that growth could reach 2% next year. The IMF is more cautious, however, predicting a 1.2% GDP hike this year and 1.6% in 2015. Indeed, in the last six months, it has doubled its predictions about Spanish economy growth.

As for the painful unemployment problem Spain is struggling to address, the IMF predicts it will be of 24.9% this year, 23.8% next year and 22.6% in 2016. It won’t fall below 20% before 2019, the IMF warns. Besides, low salaries will not help the progressive loss of purchasing power until the next decade.

The fund contradicts the public debt information that the Spanish authorities sent to Brussels, stating the highest levels will be reached in 2016 and 2017 (102% of GDP). It will fall until 100% GDP in 2019. Spain’s government reiterates debt will be under this psychological barrier in 2017.

The economy and living standards are still suffering from the legacy of the crisis. Most importantly, 5.9 million people are unemployed, more than half of them have been without a job for more than a year.

As a result, average household income remains below pre-crisis levels. Households, firms, and the government still face heavy debt burdens. The IMF acknowledges as well that unemployment is unacceptably high, incomes have fallen, productivity growth is low, and the deleveraging of high debt burdens —public and private—is weighing on growth.

Spain needs to generate inflation in order to better cope with debt, which is unfeasible unless the ECB starts more expansive policies.

The IMF recommends:

–Reducing the drag on domestic demand from private sector deleveraging with a more comprehensive, coordinated, approach to corporate debt restructuring, and by introducing a personal insolvency framework.

-Bolstering banks’ ability to support the recovery by continuing to raise capital standards over time, including the limitation of cash dividends and bonuses.

-Creating jobs for the low skilled by sharply cutting the fiscal costs of hiring them, and getting a compensation from higher indirect revenues.

-Making the labor market more inclusive and responsive to economic conditions by striking a better balance between highly-protected/permanent and precarious/temporary contracts, and further helping firms adapt working conditions (wages, hours) to their specific circumstances.

-Helping the unemployed to improve their skills and enhancing the support they receive to find a job.

–Removing regulatory barriers that prevent firms from growing, hiring, and becoming more productive, especially at the regional level.

-Gradually, but steadily, reducing the fiscal deficit to keep debt on a sustainable path, and making the tax system more growth and job friendly.

-Some monetary easing by the ECB to achieve its inflation targets.

Be the first to comment on "IMF doubles Spain’s growth forecast but warns on unemployment"