From the WSJ:

Federal Reserve officials are growing concerned the U.S. inflation rate won’t budge from low levels, the latest sign of angst among central bankers about weakness in the global economy.

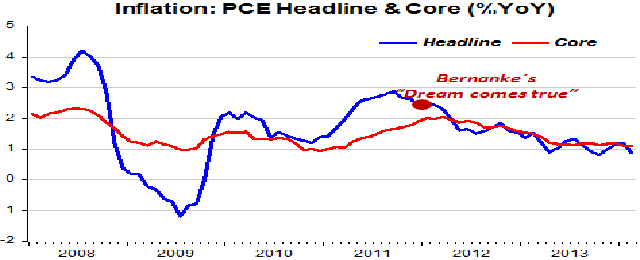

The Fed began 2014 hopeful that a strengthening U.S. economy would push very low inflation from 1% toward the 2% level that officials associate with healthy business activity. Three months into a year marked by unusually harsh winter weather, which appears to have damped economic growth, there is little evidence of such movement.

Fed officials expressed worry about the persistence of low inflation at a policy meeting last month, according to minutes of the meeting released by the central bank Wednesday. They discussed at the March 18-19 meeting whether to make a more explicit commitment to keeping short-term interest rates pinned near zero until they saw inflation move up, but chose instead to take a wait-and-see approach.

The Fed’s (and central banks in general) preferred tactic is “wait-and-see”, usually expressed in the form of “we will monitor closely”!

Ironically, it seems the realization of Bernanke’s life-long dream of establishing a formal inflation target in the US, accomplished in January 2012, backfired (see chart). Instead of becoming a focal point for the coordination of expectations it has become a barrier to getting the economy’s recovery back on track. Under those circumstances, all the talk and guessing about when rates will start to move up is surely one of the most ludicrous spectacles I’ve ever witnessed (N.E. see image above).

*Check the original post here.

Be the first to comment on "Inflation: the “target” has become a “barrier”"