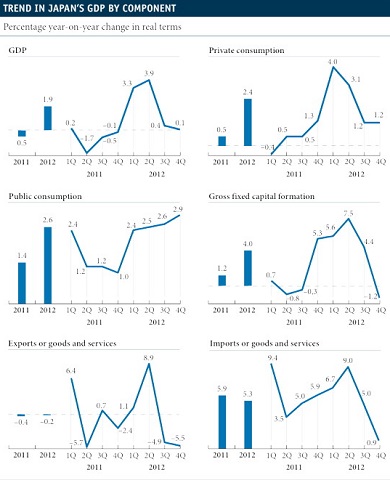

The world’s third economy posted its third consecutive quarter of quarter-on-quarter falls, thereby extending its technical recession (two consecutive quarter-on-quarter falls) and leaving growth for the whole of 2012 at an acceptable 1.9% thanks to a vigorous first quarter.

The economy should rally throughout 2013, particularly during the second half of the year, helped by the stimuli promoted by the new Prime Minister, Shimzo Abe. Quarter-on-quarter growth, in annualized terms, should therefore come close to 2.0% by the end of 2013, although the low starting point makes it difficult for growth for the whole of 2013 to exceed 0.5%.

The fall in GDP was due to an abrupt decrease in exports and capital goods investment, the two engines of growth over the last few years. The most positive part lay in the good tone of private consumption, which should continue to some extent given the improved consumer confidence index in January, which rose to 43.3 points, its highest level since August 2007.

This improved confidence is in addition to the markets’ warm welcome to Abe’s expansionary measures, with the Nikkei index accumulating gains of 31.4% since mid-November. These measures, known as Abenomics, include a more proactive attitude for monetary policy to exit deflation (with a CPI target that has gone from 1% to 2%), greater public spending for 2013 and an attempt to deactivate the nuclear switch-off.

The latest indicators offer a more positive image influenced by the initial effect of Abenomics, which is the depreciation of the yen, losing 17.8% against the dollar since mid-November.

Although the cumulative trade deficit in the last 12 months up to January reached another record of 1.5% of GDP, exports saw their second month of rises, a process that should continue with the weak yen, which improves Japan’s competitiveness compared with rivals such as South Korea. In addition to improved exports was also December’s upswing in industrial production, which in Japan is closely linked to exports. The deflationary dynamic still continues in the area of prices, however, with a CPI that, in December, fell by 0.1% year-on-year and core inflation, the general without foods or energy, dropping by 0.6.

Be the first to comment on "Japan is in recession"