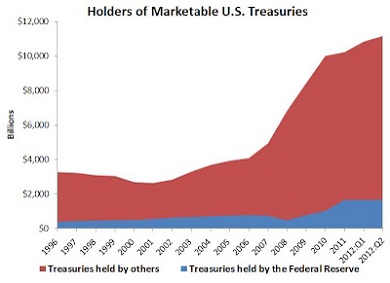

Economist David Beckworth refutes a belief that has permeated quite extensively of late: that interest rates have dropped in the US because the Federal Reserves buys everything Treasury. This is not true, as readers can see in our first chart; in fact, the Fed hardly retains between 5 percent to 10 percent of all issued marketable Treasuries.

The majority of holders are individual investors, companies and other countries, which is a sign that confidence has not been restored much more than thought. As Beckworth notes, uncertainty looms over household and corporate liquid assets.

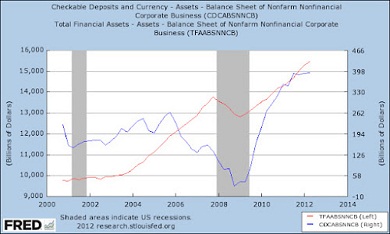

Liquid balance holdings of total assets of individuals are much higher than they were during the previous recession. Also, when it ended, liquidity suffered a correlative fall.

As for cash and deposits (blue line) and companies’ total assets (red line), it is clear that both are far from stable levels. This is what Keynes called liquidity preference, that is, generalised aversion against risk when in a volatile environment.

Expectations are considerably negative because this is a crisis that everyone is taking with all seriousness. The conclusion, or at the very least one of the most relevant conclusions, is that the threat of inflation is no such threat.

I’d add that worrying about the microeconomic causes of high unemployment, the lack of productivity, is futile. In Europe, the same applies.

Be the first to comment on "Liquidity demand and the inflation horror"