J. P. Morgan | At the beginning of the year, both the equity and bond markets were positioned for an aggressive monetary policy easing cycle. However, with core inflation remaining persistent and the US economy proving resilient, markets are now reassessing how many rate cuts central banks will make this year.

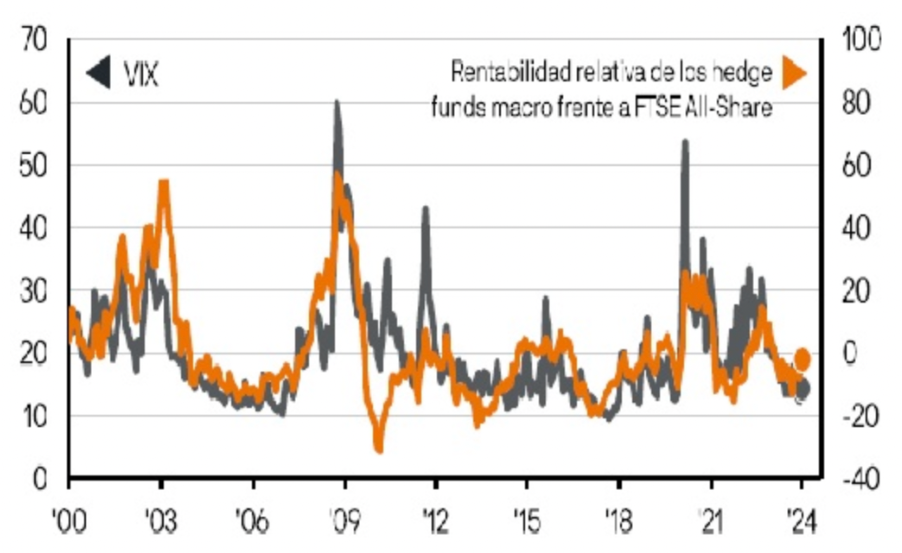

In an environment where markets continue to be affected by data surprises, we expect to see elevated volatility. In this scenario, it is worth considering the role that alternative assets can play in protecting a traditional portfolio from such shocks. In particular, macro hedge funds had a negative correlation to a traditional 60/40 (equity/fixed income) portfolio in 2022 and have historically provided diversification when equity volatility increases.

Volatility and performance of macro hedge funds: index level (left); % year-on-year change (right)

Source: CBOE, FTSE, HFRI, LSEG Datastream, J.P. Morgan Asset Management.