Yves Monzon (Julius Bär) | According to Ray Dalio, the founder of Bridgewater, 90% of governments’ attempts to reflate their economies have ultimately been successful over the past 200 years. In other words, after a few years of monetised deficits, trials and errors by policymakers, inflation will eventually rise.

Our path will therefore be a continuation of the current phase of latent deflation, gradually giving way to a rise in interest rates that will be suppressed by the central banks through yield-curve control a few years down the road. Investors will therefore face negative bond yields after inflation and taxes for many years to come and credit risk will remain or even increase until inflation takes off.

As investors face low or negative yields on government bonds and bank deposits, their demand for corporate bonds could even increase further as the asset class offers one of the few sources of income on savings. In this context, an option is to replace direct bond investments with building block bond funds dedicated to respective bond market segments.

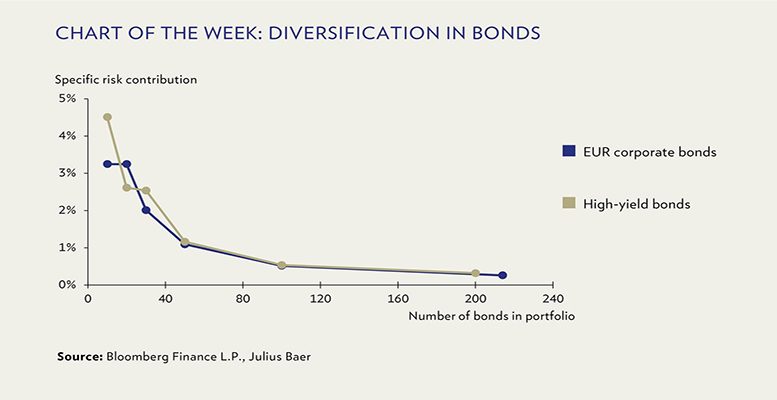

In the investment-grade space, the fees that these funds charge should primarily be considered as a diversification fee worth paying for the work of credit selection and portfolio construction conducted by the fund manager.

These fees are incidentally very reasonable, particularly in dedicated investment-grade funds, in view of the risk diversification obtained. In fact, it should be seen as a small insurance premium as opposed to a management fee. For riskier segments, such as high-yield and emerging market bonds, credit risk diversification is even more important and the good news is that skilled active managers have demonstrated an ability to add value over time in these segments.