Mondher Bettaieb Loriot / Claudia Fontanive-Wyss (Vontobel AM) | The already sweet climate for developed-market corporate bonds just got even sweeter. Indeed, Pfizer has announced that they, together with BIoNTech, are the first drugs-makers to achieve credible positive readings on the effectiveness of their Covid-19 vaccine trials. It appears that their new product can prevent 90% of infections, which is high for drugs in development. This is a watershed moment for science, humankind, and the economic recovery. In this piece, we re-iterate our positive stance for the corporate credit asset class as, in our view, the 2021 recovery is now cemented by the upcoming Pfizer BIoNTech Covid-19 vaccine.

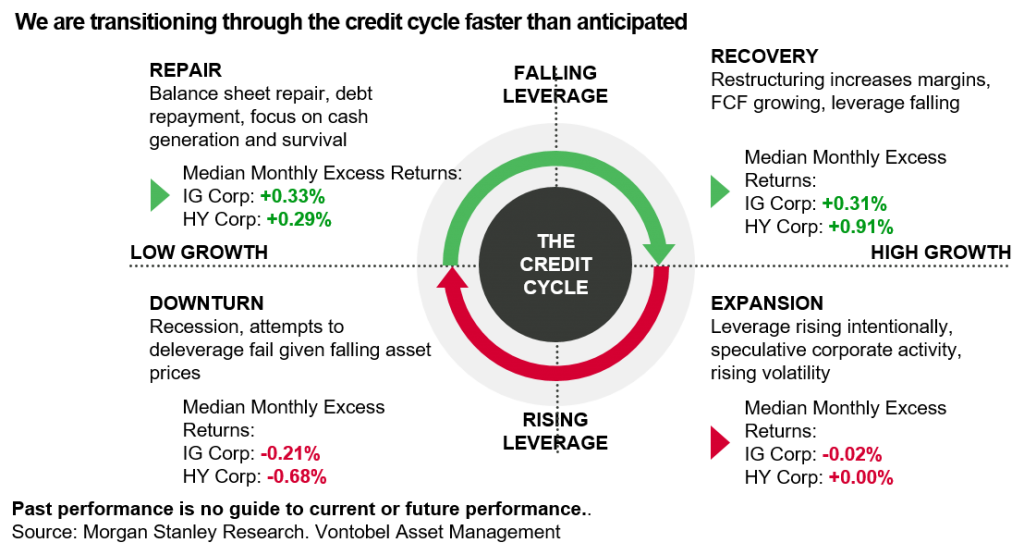

Currently, companies are shoring up their balance sheets with cash, following much better than expected results during the second and third quarters. The better results also coincide with more positive revisions in one-year forward earnings expectations. We see this as continued evidence that we are transitioning through the cycle faster than anticipated with the recovery stage likely to be reached from the beginning of next year. The recovery stage should mature sometime later in 2021 with EBITDA and cash flow generation recovering more rapidly than anticipated. We can look through the macro weakness that Covid-19 has caused, thanks to adaptation by businesses, individuals and governments that have set the stage to keep businesses running. The fiscal packages that are on the way to be augmented in both the US and euro area should also ensure that our “swoosh-like” recovery gets completed with a return to pre-Covid levels by the fourth quarter of 2021 at the latest, in our view. We note that capital expenditure plans have continued to increase since this summer and this is another good indication that we should soon reach recovery from the repair stage.

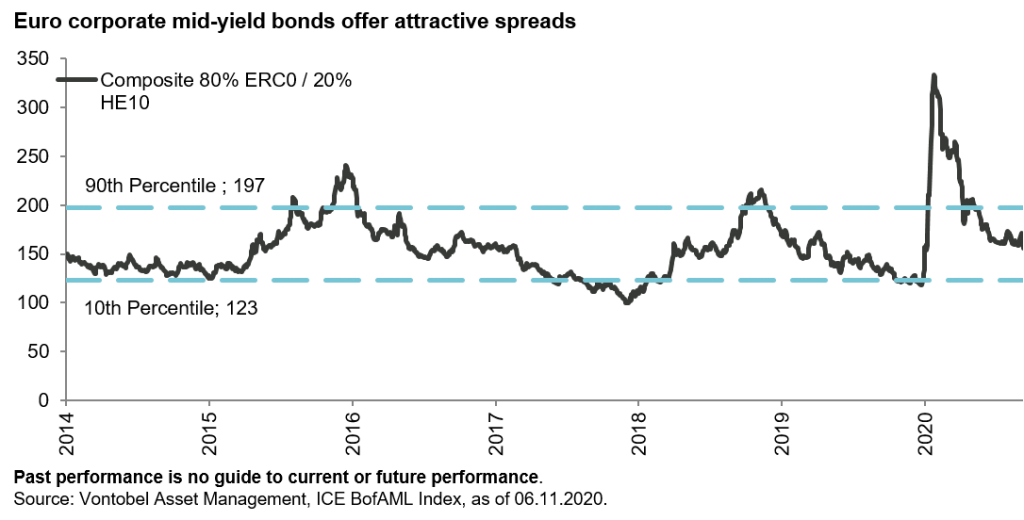

The developed-market economies should also benefit from continued monetary support, even as they recover with good coordination amongst policymakers. What happened at Jackson Hole last August is of immense importance for the low rate environment and should ensure that the recovery takes hold now that a Covid-19 vaccine is on the immediate horizon. The recovery stage is generally the sweet spot for corporate bonds and credit spreads as corporates further increase cash flows, act for the benefit of bondholders and, in the end, reduce leverage. During such a stage, spreads typically tighten and we anticipate mid-yield spreads to continue to narrow further as they are not yet back to pre-crisis levels. The shifting drivers of market cycles from the repair stage are generally supportive for developed market corporates making the recovery sweet indeed, for those investors who choose to take part in it.

Cuadro

On to the US Federal Reserve and the dovish message from the Jackson Hole. The symposium also confirmed that the Fed is worried about the lack of inflation.

You may remember that last year Mr. Powell introduced the “three eras” of Monetary Policy in his speech, but lacked a label for the third era, which began in 2010. We suggested the term “Missingflation”, which is all the more appropriate today.