In spite of a century of successful performance, this institution has had three epic failures over the years as James Pethokoukis chronicles. Here I´ll illustrate the failures from the perspective of NGDP and also show that for two decades the Fed got it mostly right.

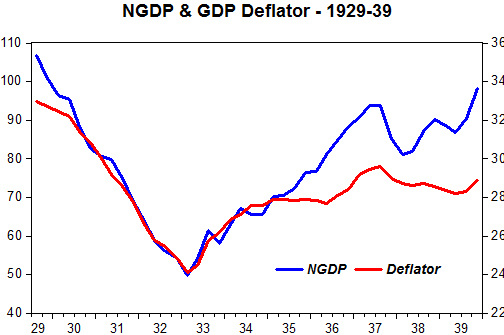

The Great Depression: When the level of spending crashed. They didn´t learn the lesson because they managed to do a repeat performance eight years on, in 1937.

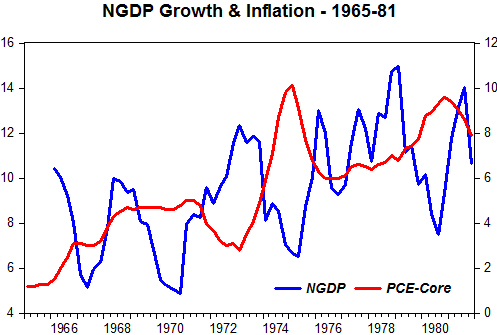

The Great Inflation: When the Fed thought that cranking up nominal spending was the best way to offset the effects of the oil shocks. And they kept saying that monetary policy could do little about inflation!

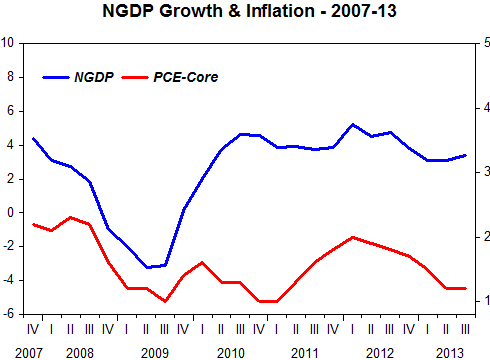

The Great Recession: When the Fed became obsessed with the inflation target and this time around thought that tightening monetary policy was the correct antidote to the oil price shock!

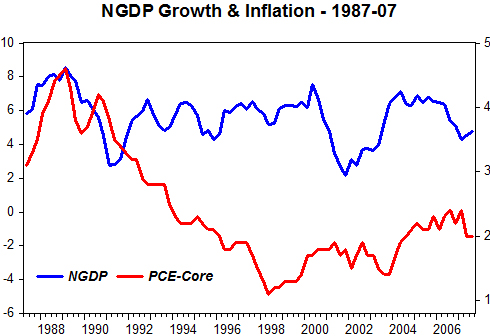

And the Great Moderation: When the Fed managed, by luck and/or design, to keep nominal spending evolving along a stable level path for most of the time.

The question is when they will learn, although there´s not much hope, according to Robert J. Samuelson:

“What’s clear is that the Fed isn’t as powerful as it seemed under Greenspan. True, once Bernanke acknowledged the crisis, he acted forcefully to pump funds into the financial system. For this, he has been widely and deservedly praised. A second Great Depression was possibly avoided; the 1930s failure was not repeated. But the Fed has discovered that it lacks the power to resuscitate the economy single-handedly. Five years of short-term interest rates near zero and roughly $3 trillion of bond-buying have, at most, modestly improved a weak recovery. On its centennial, one word best describes the Fed: frustration”.

Be the first to comment on "Right before Christmas 100 years ago… the Fed was created!"