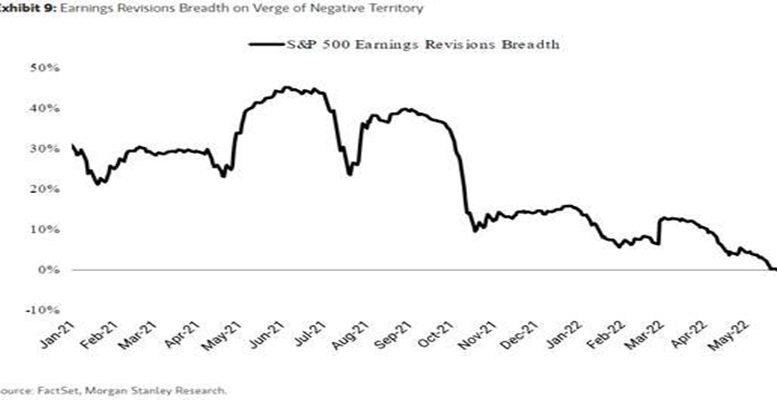

Earnings revisions moved into negative territory last week, implying that there are more downward revisions than upward revisions, a dynamic that Morgan Stanley analysts say “typically precedes EPS consolidation”. In that sense, they point out that “EPS consolidation in a growth scare environment rather than a recession is typically 3% on average … and spanning an average period of 3 months. Applying this historical precedent to the current environment results in EPS falling from the current USD238 to USD231”.

S&P 500: Already More Earnings Revisions Are Down Than Up.