Ana Racionero (Intermoney) | A Fed rate hike to 6%, a level whose risks have long been hedged in the options market, is starting to look less and less far-fetched. Powell’s appearance before the Senate yesterday unleashed a tsunami that sent bonds on both sides of the Atlantic tumbling, causing traders to recalibrate rate levels. The swap market raised the interest rate for the Fed’s September meeting to 5.60% and, as we said yesterday, Europe was pricing in 150 bps of additional ECB rate hikes.

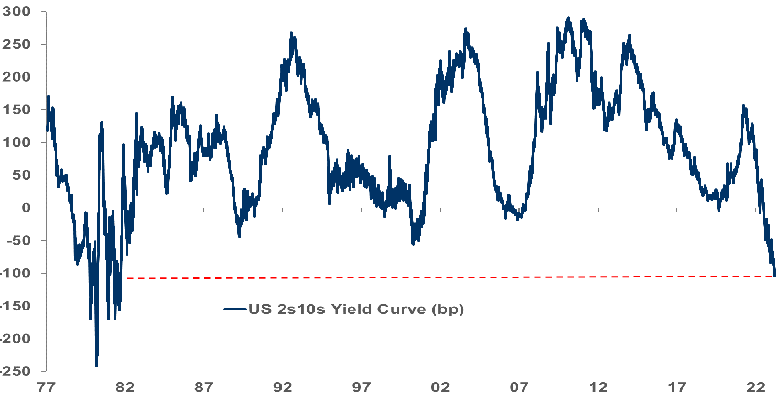

The USD rallied to one-month highs against other currencies and the 2s10 curve inverted by one percentage point (the two-year UST, which rose above 5%, the highest level since 2007, crossed 105 bp above the 10-year), something not seen since Volcker suggested a “hard landing” in 1981, and which clearly indicates that the market is betting that the Fed’s monetary policy will end up causing a recession.