Alicia García Herrero (Natixis) | The grand comeback in Asia is taking shape, but there is one missing piece. Although China, the world’s largest international travel spender, is still on its recovery path, it will eventually return to global prominence. Before the COVID pandemic, Chinese tourists had become an integral part of the global tourism sector with their spending share rising from 8% in 2010 to 16% in 2019. The positive spillover from China is therefore important, especially for economies that rely heavily on tourism.

In this note, we analyze the potential gain from Chinese tourists per market upon a full recovery to pre-pandemic levels. We calculate foreign tourism receipts in each market origin from China based on its share of tourist arrivals or travel accommodation. We then adjust the number based on the existing balance of payment data and the different behaviour of Chinese tourists in each market.

Globally, the US is the largest international travel recipient, followed by Spain and France. Within Asia, Australia, Japan and Thailand are among the countries with the biggest tourism income. However, it does not mean their exposure to China is identical.

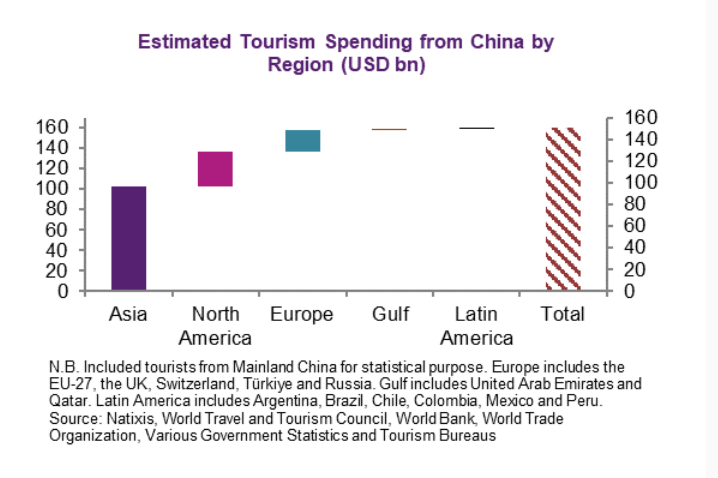

Based on our estimates, the world is set to welcome an additional $160 billion of tourism spending per annum after China’s cross-border travel fully normalizes. Asia will capture $103 billion or 64% of such expenditure, accounting for 0.65% of GDP. North America and Europe will also attract $34 billion and $21 billion respectively, but the numbers only constitute 0.13% and 0.09% of GDP.

On the country or regional level, even if the US will attract the largest amount of tourism receipts, it is not relevant for its economy. For the traditional tourism giants in Europe, such as Spain and France, the inflows will only form around 0.2% of GDP given the diversified source of tourists. Hong Kong is the real winner with $22 billion in spending, equivalent to 5.9% of GDP. For the rest of Asia, Australia, Japan and Thailand and will attract around $15 billion respectively, but the impact is the biggest for the latter at 3% of GDP. With the sole consideration of the share of GDP, Macau will see a big boost at 15% of its economy.

As mentioned in our previous note, airlines, hospitality, railways and travel spending (including booking platforms, travel retailers and cosmetics firms) will see renewed growth momentum from a low base. Asia is lagging behind its global peers and the gap reflects room for catching up and a cyclical revenue rebound. From a structural perspective, the importance of Asia is growing in spite of the COVID pandemic.

Therefore, Chinese outbound tourism spending can be beneficial for many tourism-dependent economies and sectors, especially in Asia. The downside risk is that China may carefully manage its tourism-related outflows with administrative measures given the pressure of domestic growth and consumption. Still, it is only a matter of time for the positive spillover from China’s outbound tourism to reach the world again.