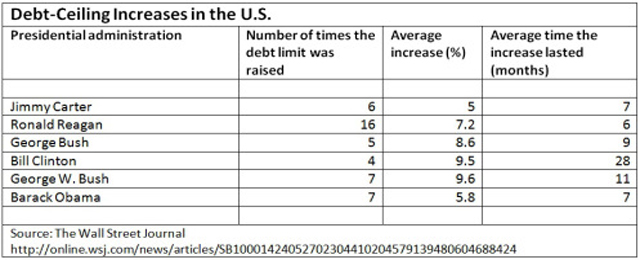

A glance at the recent history of debt-ceiling increases in the US seems to support this view. (See graph above).

Randy Yeip (Wall Street Journal) explained:

“Over the past six presidential administrations the debt ceiling has been raised 45 times, usually only when debt levels are dangerously close to the limit. In fact, 37 of those increases occurred when debt reached 98% or more of the debt ceiling. Over that period the debt limit has had to be raised, on average, every nine months. And when Congress and the president have been unable to reach an agreement to raise the limit, the Treasury Department has resorted to various “extraordinary measures” to meet its obligations.”

Nevertheless, the fears are real. The following quotes illustrate how, in many respects, the current episode differed from former ones.

The risks

Which were the risks? I would like to quote three views:

Michalis Nikiforos of the Levy Economics Institute, Bard College wrote in September 2013:

“If Congress does not agree to raise the debt ceiling, the consequences are even more uncertain and perplexing than those of the ongoing shutdown, because there is no precedent for a US government default, and there is a series of legal and technical questions that are very difficult to answer.

Examination of these consequences usually starts with the effects on the creditworthiness of Treasury bonds and the repercussions for financial markets and the real economy. If the debt ceiling is not raised, the US government will default, the rating of Treasury bonds will be downgraded to “selective default” status, and payouts on US sovereign CDSs will be triggered. This could act as a new “Lehman moment,” pushing the US and global economies back into recession.”

The Banker’s Umbrella warned:

“If we get to the point where the US is late on an interest payment on its debt (let me stress I don’t think we will) then we are in unchartered waters. The risk is this: US treasuries are held all over the world as collateral for loans. In any default situation the collateral of the underlying is adjusted. What happens when the collateral value of US treasuries is adjusted downwards? Margin calls the likes of which we have never seen. The market will go haywire as treasuries have to be dumped to raise collateral (interest rates spike) or then equities that have been bought with margin that has treasuries as collateral are dumped (stocks plummet). It’s just a very scary scenario and a thing that everyone should fear like the plague.

If we did go test those waters, then things could very quickly spiral out of control. What we saw with Lehman Brothers would be minor in comparison.”

Felix Salmon saw the damage done already and drew attention to the possible wider consequences:

“The global faith in US institutions has already been undermined. The mechanism by which catastrophe would arise has already been set into motion. And as a result, economic growth in both the US and the rest of the world will be lower than it should be. Unemployment will be higher. Social unrest will be more destructive. These things aren’t as bad now as they would be if we actually got to a point of payment default. But even a payment default wouldn’t cause mass overnight failures: the catastrophe would be slower and nastier than that, less visible, less spectacular. We’re not talking the final scene of Fight Club, we’re talking more about another global credit crisis — where “credit” means “trust”, and “trust” means “trust in the US government as the one institution which cannot fail”.”

And he added: “If Treasury payments can’t be trusted entirely, then not only do all risk instruments need to be repriced, but so does the most basic counterparty risk of all. The US government, in one form or another, is a counterparty to every single financial player in the world. Its payments have to be certain, or else the whole house of cards risks collapsing — starting with the multi-trillion-dollar interest-rate derivatives market, and moving rapidly from there.”

*Continue reading here.

Be the first to comment on "The U.S. debt drama – soap opera or Lehman quality?"