Pablo Pardo (Washington) | If in any country the word “socialist” is an insult, it is in the US of 2019. “Socialism” has become the war cry of the Republican party against the opposition Democrats, who control the House of Representatives, in large part because the media star of this party in the Congress, Alexandria Ocasio-Cortez, describes herself as a “democratic socialist”.

The concept of “democratic socialist” was invented in Senator Bernie Sanders´ 2016 election campaign, when he came close to taking the presidential nomination from Hillary Clinton. Sanders is not a Democrat, but an independent who places himself to the left of the party. But wen he competes for the presidency as in 2016 and again this year, he registers as a Democrat to be able to take part in the primaries.

Nobody knows what a “democratic socialist” is. But the point is that to call your rival a “socialist” works wonders with Republicans, who tend to follow this word with another: “Venezuela”. In reality, Sanders and Ocasio-Cortez are closer to the European welfare state, which in Spain is supported by all political parties, from Vox to Podemos, than the hyperinflationary Bolivianist experiment. But US voters do not know this. Nor, in many cases, do they want to know. The idea that “Europe is bankrupt” is a widely repeated phrase in US public opinion, although then combined with endless complaints about the invasion of German cars – which, according to the Trump administration, threatens national security – or competition by Airbus.

But now, paradoxically, socialism is beginning to be considered for an institution which, in theory, has nothing to do with this: the Federal Reserve. For four decades – since the arrival of Paul Volcker as chair in 1980 – the Fed represented, from a theoretical point of view, monetarism, with different variants. And, in practical territory, its primary objectives were, first, containing inflation and, then, supporting financial markets. Obviously this latter concept was never stated in black and white. But the famous Greenspan put – Greenspan´s “put”, in reference to the options for selling an asset at a determined price – was no more than a sophisticated way of saying that the Federal Reserve would always intervene if fixed or variable income had problems. Today, almost a decade since the departure of the man who was then hailed as the “Master” of the Federal Reserve presidency, the bank continues to pay at least as much attention to financial indices as other economic indicators.

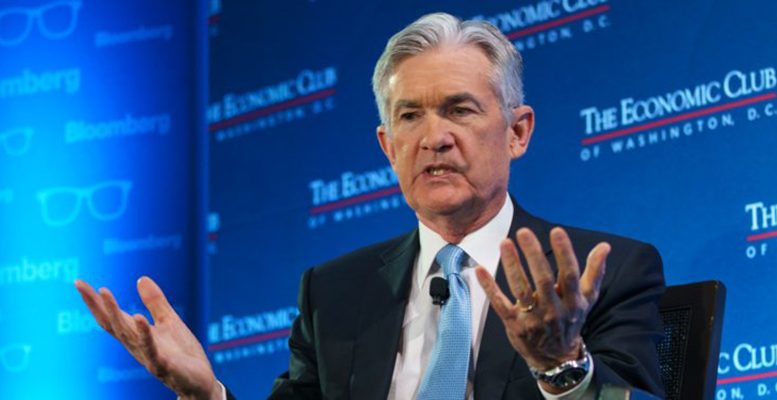

But the political and economic environment has changed. And, paradoxically, the Fed of Donald Trump is being pressured to add a dose of socialism to its monetarism. This was clear in the last week of February, when the Chairman of the Federal Reserve, Jerome (commonly known as “Jay”) Powell appeared before the Senate and the House of Representatives respectively. Although many of the legislators´ questions focused on financial and macroeconomic issues, like the economic slowdown this year and the impact of Donald Trump´s trade wars, a significant part of the debate centred on how Powell and his colleagues can focus monetary policy on increasing wages and reducing the economic division between workers and investors.

The problem is that the Federal Reserve´s ability to deal with this is limited. It is true that the central bank can stop raising interest rates and suspend the sale of bonds. In fact, it has let it be understood that this is what it is doing. But Abenomics, which until now has been successful, is also based on fiscal expansion. And here the political problem is considerable. The US is indeed in a fiscal expansion, but only for capital income and companies, not for wage earners. Any military measure aimed at non-military public spending with the idea of increasing demand, employment and wages would be described, by Cotton, Trump and the other Republicans as socialism. Today the US Government wants a monetary socialism which, as far as possible, is not much noted.