Warren Buffett has rightly described the debt ceiling as a weapon of mass destruction. The equivalent to an atom bomb thrown at the very heart of Wall Street. It cannot be decommissioned, for it would deprive Congress of its key budgetary authority, nor being used as such an option would be tantamount to ruin the country. Markets have readily dismissed any potential implosion. But unless a fair bargain is reached within weeks, further crises are to be expected next year.

The Congress should redress, the sooner the better, the huge confidence gap the Republican majority in the House has so foolishly fuelled. It should deliver the stable budgetary framework it has so far adamantly refused to the US Administration. Democrats should be flexible enough to meet demands for curtailing the current ramping deficit.

Investors are betting the Federal Reserve will be forced to shelve any plan on asset buying tapering, running monetary policy on a cheap money stance for a long time to come. Yet, backing away from announced plans would severely undermine its standing. It is bound to take action before the year close if only to remind everyone who holds the purses’ strings. Failure to do so would tarnish the forthcoming Chairwoman’s mandate.

It is too early to assess how the shutdown and the ensuing uncertainty may hit the real economy. Many people have switched away from consumption as potential default loomed ahead until the very last day. Unless they are reassured by a lasting compromise, they might shrug off the end-of-the-year sales’ bonanza thus failing to invigorate demand at a critical time. So long as doubts linger on, growth will suffer.

The Congress has provided itself a short breathing space to arrange the current disarray. It should not lose a single minute in trying to strike a balanced deal. Otherwise we shall be confronted with a similar tug-of-war in a couple of months with the potential to dash all hopes of a sustainable recovery.

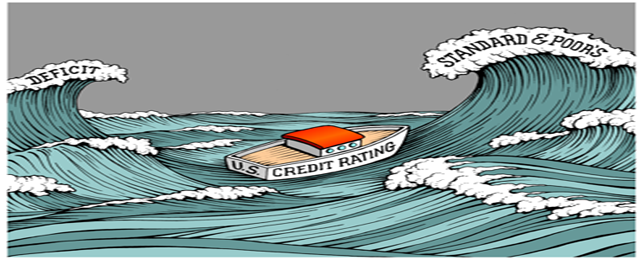

*Illustration by John Pritchett at The Hawaii Reporter.

Be the first to comment on "U.S. creditworthiness at stake"