Kevin Flanagan, Head of Fixed Income Strategy, Wisdom Tree | When following rate trends, it’s easy to focus only on US factors. You know, the Federal Reserve (the Fed), the monthly jobs report, etc. However, there have been some interesting developments in Europe that have been largely ignored in market commentary that got me ‘thinking globally’.

One of the foundations for the lower US Treasury (UST) 10-year yield over the last few years has been the lack of any other alternatives in the developed world sovereign debt markets. Indeed, negative government bond yields abroad had presented fixed income investors with few, if any, other alternatives to consider. While either zero or negative rates are still prevalent in the government bond markets of Japan and various countries within the Eurozone, the UST 10-year yield does not offer the same advantage as it once did.

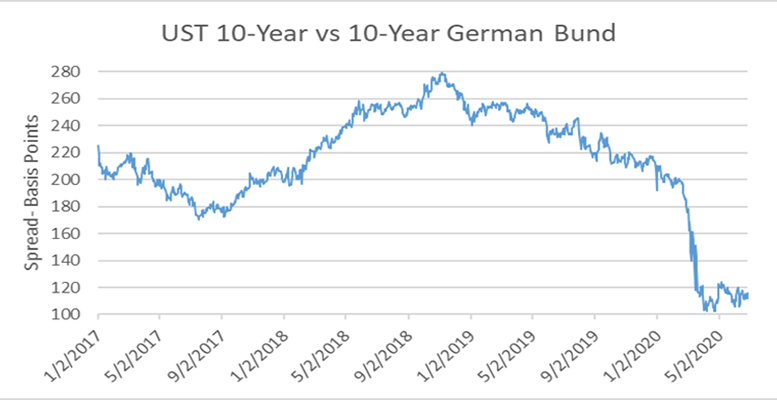

I wanted to highlight the yield differential, or spread, between the UST 10-year and two other closely watched sovereign debt arenas, Germany and Italy. In each case, it is readily apparent that this spread has narrowed in a rather considerable fashion over the last year or so.

Let’s look at the 10-year German bund. Back in November 2018, the UST counterpart had a yield that was nearly 280 basis points (bp) higher, but that differential has plummeted by roughly 170bp this year, and now stands at ‘only’ +112bp[1]. For the 10-year Italian BTP, the spread was as high as 100bp in September 2019 but has since reversed course completely and is now in negative territory. In other words, instead of the Treasury 10-year yielding more than its Italian counterpart, it now yields 65bp less, a remarkable turn of events.

What’s the main factor at work you may ask?

Interestingly, there has been a divergent pattern in each instance. For the

periods under review, the German Bund yield fell while the Italian BTP yield

actually rose. However, the one key constant is the fact the UST 10-year yield

has plunged. To provide some perspective, in November 2018, the yield was

nearly 3.25%, and in September 2019, the level was 1.90%. Today it’s 0.64%[2]…the

math is pretty easy!

[1] As at 29 June 2020

[2] As at 29 June 2020