U.S. Treasuries Watch: Thinking Globally

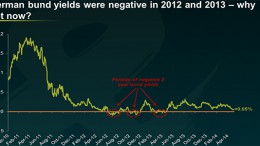

Kevin Flanagan, Head of Fixed Income Strategy, WisdomTree | While we don’t envision the UST 10-year yield revisiting the aforementioned 2018/2019 levels any time in the foreseeable future, it no longer has the same tailwind speed ‘at its back’ when ‘thinking globally’.