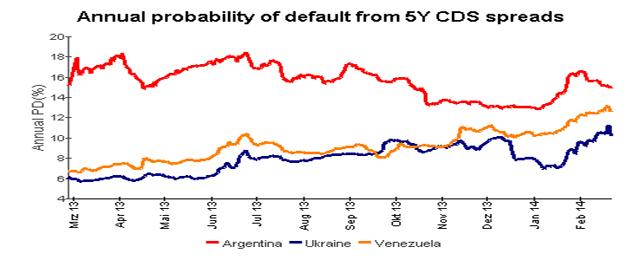

Ukraine default risk is way up, but Ukraine has barely closed the gap with Venezuela in the default probability race and Argentina, with its pari-passu case now under review for cert at the Supreme Court, is still way ahead with its CDS-implied likelihood of default. I know its hard to look at pictures of Kiev and think “that looks like a safe sovereign credit,” but even with the recent run-up Ukraine still has a market-implied default hazard at only about 60% of the level of Argentina.

Those are some graphs at the link from the CDS-implied default probabilities page from Deutsche Bank.

Part of the run-up in the Ukraine and Venezuela insurance prices is due to Argentina’s repeated losses in their pari-passu case. Should they be denied cert or lose at the Supreme Court, other nations with pari-passu clauses will find it both difficult to restructure and harder to selectively default. That is driving up CDS rates across the risky sovereign space, mostly because of lower recovery in CDS settlement auctions. On related issues with pari passu see this law and econ paper.

The difference between Ukraine and Argentina probably says something about the importance of willingness to pay versus ability to pay and willingness to pay is what really matters.

Be the first to comment on "Ukraine vs. Argentina, which country is more likely to default?"