So France, how does it feel to lose the triple A risk ratings by Moody’s? Core euro zone economies were never going to get away unharmed from the savage, yet mostly self-induced, budget corrections that club Med is tumbling through.

Southern European countries have depressed their consumption down to levels sufficiently recessive as to have begun dragging their neighbours with them. No only that, but pressure for structural reforms has shifted towards Paris, too, a Barclays report noted Tuesday accusing the French government of having remained stalled while all the austerity action and improvements in labour market and competitiveness concentrated over the Athens-to-Lisbon front. The now infamous image of explosive baguettes by The Economist hunts French president François Holland.

Domestic demand in France has behaved in quite a resilient way. Indeed, the country did not suffer from debt overhang or the major macroeconomic imbalances of the euro area’s periphery. But one reason for the apparent French strength, Barclays analysts pointed out, is simply that investors in sovereign bonds have treated French government debt with soft gloves, so it has avoided the fiscal and financial constrictions Rome and Madrid live with.

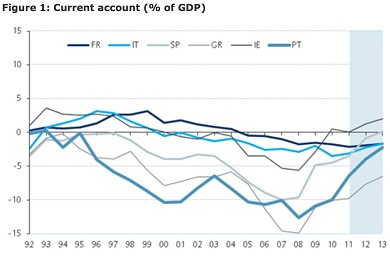

“However, the medium-to-long term outlook does not look bright given the structural weakness that need to be addressed,” Barclays Capital explained. “On the export side, market shares have resumed their consistent decline after recession. As a result, France is one of the few countries in the euro area where the current account has kept deteriorating and is now around -2.5 percent of GDP”–France had a current account surplus of 3.1 percent of GDP when the European Monetary Union was set up.

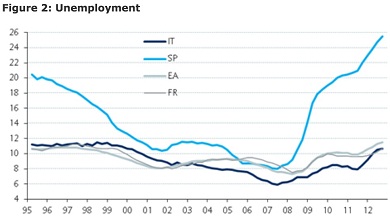

Tellingly, unemployment has been growing since the last quarter of last year, and jobless numbers among young people is, in Barclays experts’ words, “flirting with historical highs, as is the case for the number of long-term unemployed.”

France has been advised by international institutions like the IMF and euro partners like Germany to do its homework before it’s too late. The answer that has come from the Elysée Palace, unfortunately, isn’t auspicious.

Still, Barclays believes “broad negotiations [recently initiated between government and unions and employers’ organisations] are difficult to manage, but they create opportunities for all the negotiating entities to lock in successes and save face. They also increase the overall positive impact of individual reforms.”

By 2014, it is expected that France has implemented structural labour market and banking reform (December 2012), spending cuts and changes in social security financing (early 2013) and administrative reorganisation and regional spending cuts (during 2013). This time, everybody will be watching.

Be the first to comment on "Wake up, lazy François! You are in time, says Barclays"