Mirabaud | There has been a lot of talk about semiconductors and the extent of the shortage we’ve experienced since the start of the coronavirus crisis. However, while the consensus is betting on a return to normalcy in early 2022,we should perhaps look to 2023 instead, particularly because of the expansion of … cryptocurrencies.

a. The facts

Daimler AG’s chief executive yesterday warned that the global semiconductor shortage may not disappear completely next year and that it would take until 2023 to resolve it.

Ola Kallenius, CEO of Mercedes-Benz, issued the warning at a meeting with journalists ahead of this week’s motor show in Munich.

Daimler recently cut its annual sales forecast for its car division, predicting that deliveries will be roughly in line with 2020, rather than significantly higher.

Before that, Carlos Tavares, the CEO of Stellantis, told a meeting in Detroit, one of the cradles of the automobile industry, that, “The semiconductor crisis, from everything I see and I’m not sure I can see everything, is going to drag into 2022 easy because I don’t see enough signs that additional production from the Asian sourcing points is going to come to the West in the near future”. Thus, fewer and fewer players are counting on a quick exit from the crisis.

However, a few months ago, Cisco CEO Chuck Robbins had indicated that the end of the crisis would come in around 12 to 18 months, i.e., in mid-2022.

However, the semiconductor shortage could last longer than expected for a variety of reasons, forcing analysts to revise their estimates and adjust upwards their view of (semiconductor) manufacturers.

b. 2020, annus horribilis for the semis

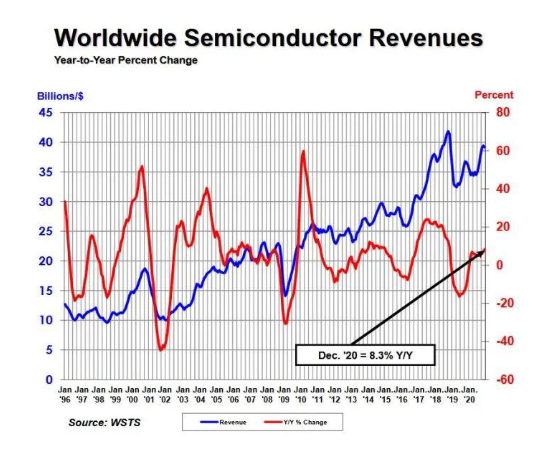

While overall semiconductor growth was positive in 2020, it fell short of analysts’ pre-Covid-19 forecasts. According to the WSTS annual review, the global semiconductor market was worth $439 billion in 2020, up 6.5% on 2019.

Only Europe showed a declining market in 2020. On a regional basis, annual sales in the US market stood out, increasing by 19.8% in 2020.

China remained the largest individual semiconductor market, with sales totalling $151.7 billion in 2020, an increase of 5%. Annual sales also increased in 2020 in Asia-Pacific/Rest of World (5.3%) and Japan (1%) but

declined in Europe (-6.0%).

Various semiconductor families stood out in 2020. Logic circuits ($117.5 billion in sales in 2020) and memory ($117.3 billion) were the largest semiconductor categories by sales.

The growth of global semiconductor sales thus increased moderately on an annual basis in 2020, while many hopes were raised with the development of components for electric vehicles (don’t hesitate to ask me for my

study on the subject).

c. What are the semi growth forecasts for 2022?

According to the Susquehanna Financial Group, the average delivery time for semiconductors is now over 20 weeks, up from 14 weeks at the beginning of the year.

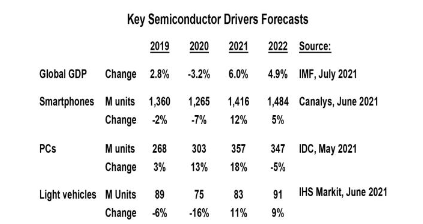

Once semiconductor supply catches up with demand, growth in 2022 will depend on the economy and demand for final equipment.

In July, the International Monetary Fund (IMF) forecast that global GDP would grow by 6% in 2021 as the world recovers from the pandemic. The IMF expects the recovery to maintain its momentum in 2022 with

growth of 4.9%, up from the May forecast of 4.4%.

Demand is expected to be driven by sales of:

Smartphones: Canalys expects the smartphone market to rebound with a 12% gain in 2021 after a 7% decline in 2020, mainly due to manufacturing disruptions related to the pandemic. Canalys forecasts 5% growth for smartphones in 2022, which is higher than the growth rates in the four years prior to the pandemic.

• PCs: In May, IDC forecast an 18% increase in PCs in 2021 and a 5% decline in 2022. In the second quarter of 2021, PC shipments showed a slowdown in growth, but 2021 is still expected to show a double-digit gain in PC units. The growth of gaming is of course also a reason for PC growth in 2020

and 2021.

Vehicles: IHS Markit forecasts light vehicle (car) production to be 83 million units in 2021, up 11% from 2020. Vehicle production in 2021 has been constrained by the semiconductor shortage. In 2022, light vehicles are expected to rise sharply by 9% as the industry catches up with pre-pandemic production levels.

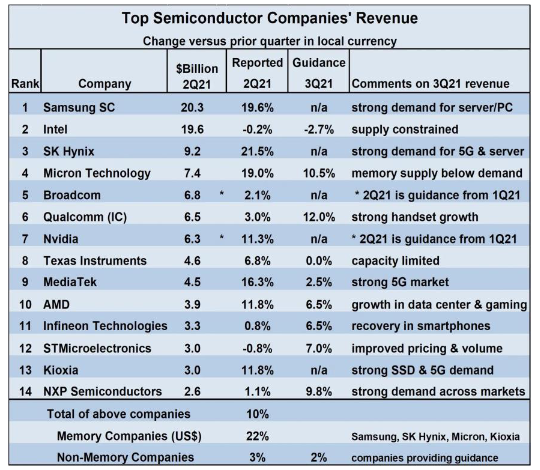

Semiconductor sales growth will moderate in 2022 after a gain of over 20% in 2021. IC Insights forecasts that the integrated circuit (IC) market growth rate will average 13% for 2022 and 2023. WSTS’s update of its spring

2021 forecast shows a 10% increase in 2022. Semiconductor Intelligence’s forecast is for a 15% gain in 2022.

Semiconductor market growth of more than 10% in 2022 would be considered “healthy”, compared to the long-term growth rate. Thus, much of the market momentum in 2021 is expected to continue into 2022.

d. Let’s stop fantasising about repurposing the production line

An urban legend has recently cropped up according to which a semiconductor production line dedicated to make toasters, for example, can be immediately reassigned to build electric cars. This is far from being true.

Indeed, the repurposing of a highly complex chip production line is a time-consuming exercise, one that can take several years. Many semiconductor manufacturers think twice before sending hundreds of millions of

dollars’ worth of photolithography machines (designed by ASML, among others) to another plant dedicated to another sector. There can be as many as 1400 process steps (depending on the complexity of the process

used) in wafer-level manufacturing. And each process step typically involves the use of a variety of highly sophisticated tools and machinery.

In most cases, manufactures choose instead to “simply” delay deliveries and increase their backlogs.

e. …and about increasing capacity

As the SIA, the US semiconductor manufacturers’ association, explains, increasing semiconductor capabilities takes time, as semiconductors are incredibly complex to produce. It can take up to 26 weeks to manufacture a finished chip. Typically, the manufacturing cycle time for a semiconductor wafer takes an average of 12 weeks but can take up to 14-20 weeks for the most advanced processes. Then the chip packaging (test and assembly) can take another 6 weeks. Therefore, the lead time from the placing of an order to the receipt of the final product can be up to 26 weeks.

This means that while the semiconductor industry is currently doing all it can in the short term to increase capacity utilisation of existing production to meet increased demand for automotive all other customers, this will not easily reduce the shortage. In the long term (beyond 2 years), total global manufacturing capacity will have to increase to meet the growth in demand. Indeed, the latter can only be met by increased utilisation of existing production capacity.

f. The unexpected game changer

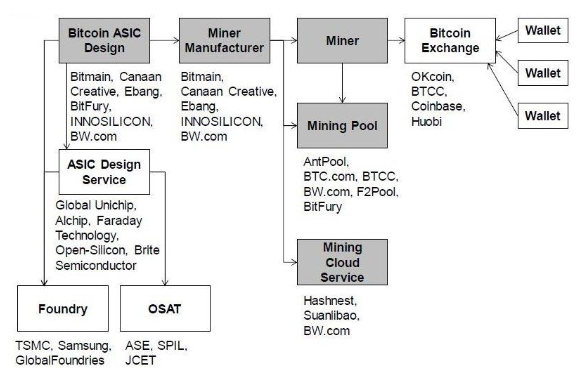

While everyone is focusing on the growth in demand for semiconductors from smartphones, PCs and cars, a key player is being overlooked when it comes to demand: cryptocurrencies.

This is because cryptocurrencies need a lot of processing power to function. Which means that crypto-currency miners buy graphics cards and processors in large numbers.

So much so that Nvidia had to halve the hash rate (mining efficiency) of the GeForce RTX 3060 graphics card for Ethereum miners via a software update in order to ensure sufficient supply for gamers.

All this has also led to an increase in the price of graphics cards and a drop in their availability.

More impressively, according to Nomura Bank, as a result of the bitcoin and crypto-currency rally earlier this year, demand from crypto-currency miners accounted for a tenth of the total sales of TSMC, the world’s third largest chipmaker!!! Evidently, the demand from the crypto-currency industry has a huge influence on the chip market.

g. Conclusion

Whether it is due to US-China trade tensions, Covid-19, the rollout of electric vehicles, the smartphone replacement cycle, or increased demand for cryptocurrencies, the semiconductor shortage will continue for at

least the next 18 months. Increased new capacity and the reassignment of some production lines will therefore not fully offset demand until 2023. This confirms once again our extremely positive view of the semiconductor

sector (feel free to ask me for more details on the sector).