And the ECB grabbed the mike

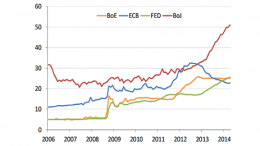

LONDON | Barclays analysts | Central banks will remain in the spotlight this week, with banks in Europe, UK, Australia, Malaysia, Thailand, Poland and the Czech Republic all set to deliver policy decisions. Of these only the NBP in Poland is likely to move, cutting policy rates by 25bp, in our view. However, most attention will be on the ECB for any hints of future QE, as economic data remain a challenge.