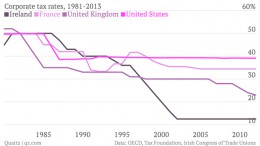

Corporation tax: Irish soften stance amidst growing international pressure

MADRID | By Sean Duffy | The OECD´s announcement this week that it was initiating a plan to combat tax avoidance schemes from multinationals has been met with almost universal approval across Europe. Ireland in particular has been the subject of criticism from its EU partners. Until recently, the country had determinedly defended its tax policy, famously refusing to negotiate on the issue when the country was in need of an EU bailout back in 2009.