European bond rally may have reached a turning point

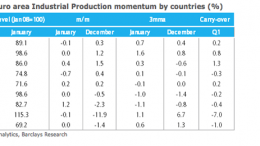

LONDON | March 14, 2015 | Barclays | German 10y yield bounced back to 0.248% after touching 0.186% on Thursday, while Italian and Spanish 10y spreads are 10bp above their trough. High yield credit spreads tightened while equities remained close to their cyclical highs. EURUSD is now trading at 1.06 after dropping below 1.05 on Thursday (its weakest level since January 2003). Europe’s IP edged down 0.1% in January, slightly weaker than expectations.