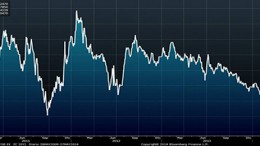

Draghi asserts his authority

MADRID | By JP Marin Arrese | A couple of years ago, Draghi rescued the Euro from its plight. Yesterday, he saved Europe from a protracted economic performance. By delivering more than expected by markets, he changed the rules of the game in monetary policy. His bold rate cut bringing funds hoarded by banking institutions into negative territory seems close to unconventional manoeuvring. His targeted 4-year massive 400 billion liquidity injection will prop up credit to enterprises and individuals, providing a robust boost to growth.