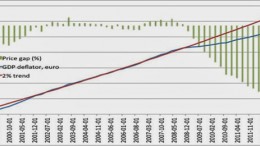

MADRID | The Corner | Although it is not part of ECB’s mandate, last Friday in Jackson Hole, President Mario Draghi spoke about what needs to be done in the euro area to address the problem of high unemployment and weak economic growth. As Barclays analysts believe, the speech “represented a significant breakthrough in the ECB rhetoric and will probably have significant implications regarding the debate just about to start between European government on policies that need to be deployed to avoid a ‘triple-dip recession’ and a fall in outright deflation.”