The S&P500 Trades At 23.5 Times Earnings And So Much Euphoria Causes Vertigo

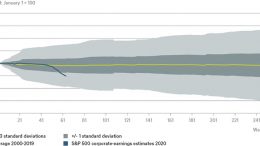

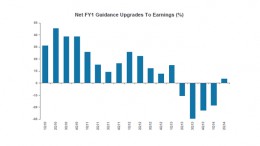

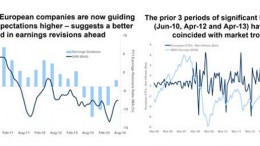

T.C | From today until Thursday, companies representing 40% of the S&P500 will present their results for the first quarter of this year. Alphabet and Microsoft today, Tuesday. Apple and Facebook on Wednesday, Amazon on Thursday… and expectations are very high indeed. For example, in the case of Apple, a 32% advance in profits is discounted, while in the case of Tesla, which presents on Tuesday, a +71% increase in both revenues and profits is expected.