fixed-income

The ECB: Game changer in fixed-income markets?

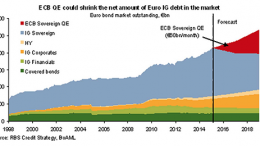

The Corner | March 13, 2015 | With its ambitious QE programme, the European Central Bank has become a new buyer in the debt market, absorbing almost 15% of total fixed-income debt in the eurozone. Who will benefit most in this new environment?

Fixed-income, a Good Business for Banks

MADRID | By Francisco López | In the current context of scarce credit activity and low interest rates, a substantial part of banks’ financial income originates in the fixed income portfolio. The banking sector’s balances of fixed-income come to €540 billion, which represent 17% of the total balance (around half of them being public debt).

Fitch EU senior fixed-income investor survey shows most favour fiscal union

LONDON | Ratings agency Fitch released on Monday the conclusions of its latest survey of the opinions of a hundred fixed-income asset managers with an estimated $7.2-trillion business volume. More than 80% of respondents work at the top 20 and 50 investing houses in Europe, so their views on the euro zone’s future are meant to be telling. And they are: fiscal integration is seen as the final station of…