Interest rate moves are out of sync with inflation, what next?

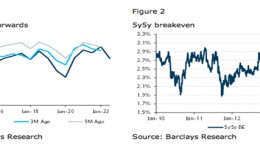

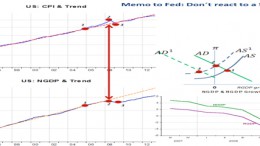

LONDON | By Michael Gavin at Barclays | The 2013 sell-off in interest rates in the global currency areas has been driven entirely by perceptions that economic activity is on course to continue its recovery; inflationary pressures have been conspicuous only for their absence in all major currency areas except Japan, where the (still limited) pressure is welcome. This likely explains why equity markets in the advanced economies were so resilient to the backup in US and global rates and why the brunt of the 2013 bond sell-off was borne largely by the long end of the curve.