Repsol: Undesirable Consequences

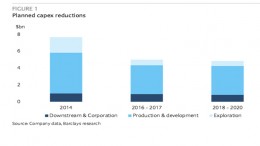

The drop in oil prices and the belief – rarely justified by experience – that things will never be what they were, have begun to set off alarm bells in some of the major sporting activities. These have provided an amazing bounty of triumphs thanks to Repsol’s generous patronage.