Bankinter expects 3Q vertigo in sound cycle

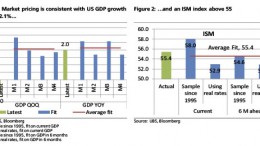

MADRID | Bankinter Analysis | 3Q Perspectives. Economic cycle speeds up and, mostly, gains soundness and reliability. Global growth will consolidate in 2014/2015 by +3%/+4% with positive news for developed countries and less favorable surprises in emerging markets. Japan and India are the exception to this rule. Spain will also amaze and main economic risk will lie in regional regional integrity issues whose aftermath may be undervalued, regardless the final scenario.