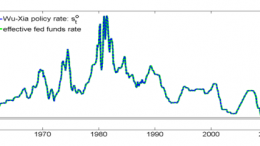

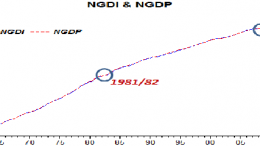

There´s no “secular stagnation”, it´s about misguided monetary policy

SAO PAULO | By Marcus Nunes | Larry Summer made a splash with his closing speech at the IMF Conference. That was probably his intention following him being denied the Fed Chair. Several people have taken turns both critiquing and asserting his “secular stagnation” thesis.