US economy: Playing the “let’s pretend things are great” game

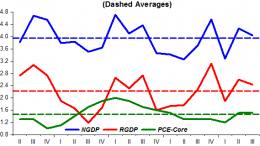

SAO PAULO | By Marcus Nunes via Historinhas | If things get worse [for the US economy], that’s the fault of weak growth in Europe and the BRICS, having nothing to do with bad monetary policy by the Fed itself. Keep wearing those rose-tinted glasses and soon everyone will start feeling things couldn’t be better!