Effects of the deflation on debt

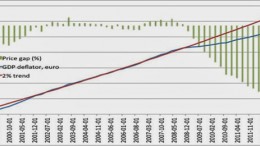

MADRID | By Luis Arroyo | The Spanish National Statistical Institute has recently published May’s CPI. The chart shows the 0.1% annual variation with respect to May 2013. Such variations determine a curious outcome on the price level, as the second chart exhibits.