The BIS is a legendary bank that used to have an important role in the interwar period, although today it is mainly focused on asking for the rise of interest rates.

Both Evans-Prichard and Krugman give Mr Caruana a slap in the face for that.

“Their champion is Jaime Caruana, head of the Bank for International Settlements (BIS). “The historical evidence indicates that deflations have often been associated with sustained growth in output. The Great Depression was more the exception than the rule,” Evans-Prichard said in March.

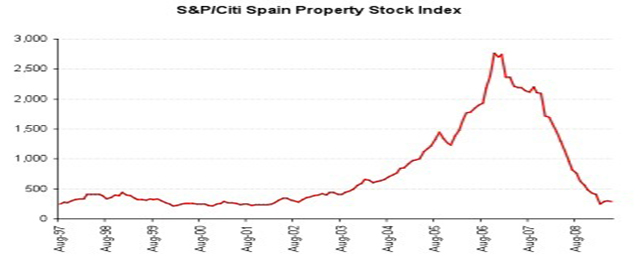

Mr Caruana is not a spooky fellow, he is simply an inept. When he was Governor of the Bank of Spain he didn’t move a finger to stop the bubble, something that earned him a public letter from the group of inspectors alerting public opinion of what was being cooked. But, as Mr Aznar would say, “it was not the right time.” Apparently it was time for the bubble to burst and for usa ll to think that we were becoming richer every day.

Now that we have been impoverished by the Aznar and Caruanas, Rodríguez Zapatero and Rajoy, we still need top put up with this man saying that deflation is freaking great and we need to raise interest rates. He has no idea of economics. But his cronies in the Spanish government are comfortable with that because it them to say that the economy has grown by 0.4% in the last quarter, thanks to the deflation of 0.4%.

“Spain is the test case of the rebound story. It is the new poster-child of EMU austerity, the vindicator of internal devaluations. It grew 0.4pc in the first quarter, the strongest in six years, even though exports fell by 0.6pc. This was achieved in part by estimating the “GDP deflator” at -0.4pc. If that is the real level deflation already lodged in the Spanish economy, they are in big trouble. Nominal GDP shrank each quarter last year: €256,918bn (Q1), €255,435bn (Q2), €255,336bn (Q3), €255,299bn (Q4). Yet this base has to carry a total debt load of roughly 340pc of GDP,” writes Ambrose Pritchard.

And there he is, Mr Caruana, chairman of the BIS.

Be the first to comment on "BIS head: from ignoring the Spanish bubble risks to ignore deflation"