ECB endorses balance sheet target

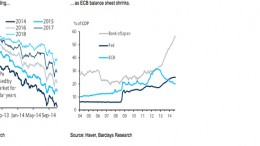

MADRID | The Corner | As expected, the ECB’s Governing Council left the policy rates and the ABSPP, CBPP3 and TLTRO programmes unchanged and expressed its endorsement for increasing the central bank’s balance sheet to its size at March 2012, that is, around €3Tr. Draghi explicitly pointed out that they would evaluate further measures in case that the current purchase programmes are not enough to expand the balance sheet or if the EZ inflation outlook worsens. With policy rates at the zero bound, pressure is mounting on the central bank to act.