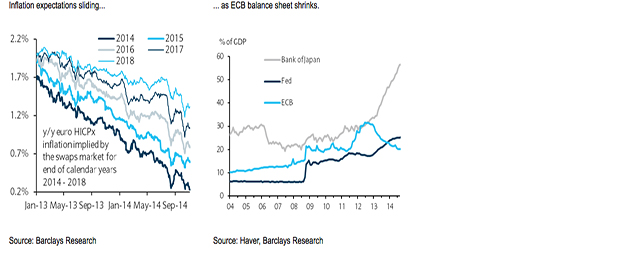

“We expect that both contingencies mentioned by President Draghi will likely be triggered. The ECB’s balance sheet is unlikely to grow significantly under the current programmes. We estimate that for 2015 the ABSPP will reach c. EUR60bn; the CBPP3 will add about EUR50bn; the Sep 14 and Dec 14 TLTRO about EUR150bn (net), and the 2015 TLTROs EUR100-150bn. These measures will not be sufficient to achieve the targeted balance sheet expansion in our view. Second, we project 2015 growth to remain anaemic at 1.1% (ECB 1.6%) and inflation at 0.7% (ECB 1.1%) with downside risks,” analysts at Barclays commented on Thursday.

Some market watchers believe the Frankfurt-based institution, which became the only supervisor for 130 European banks this week, will move towards QE by early 2015 in order to help re-anchor inflation expectations and weaken the euro further.

“Although the ECB continues to stress that the exchange rate is not an explicit target, clearly the euro area economy could ill afford renewed exchange rate strength in the current environment of near stagnation, persistently low inflation and significant risk of outright deflation. We estimate that a 10% effective (trade-weighted) euro depreciation would raise both consumer prices and output over the following year by about 0.5%,” the same Barclays experts pointed out.

Be the first to comment on "ECB endorses balance sheet target"