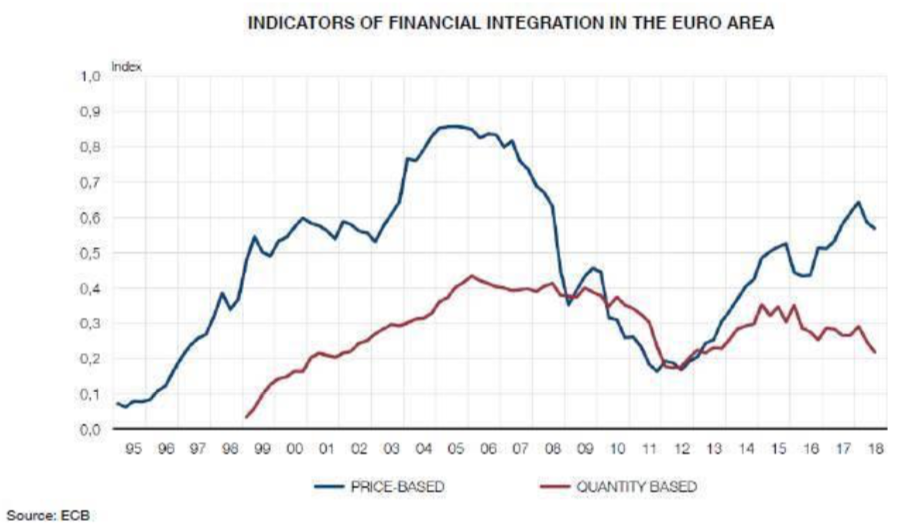

José Luis M. Campuzano (AEB) | The ECB itself admits that the exceptional monetary expansion measures have favoured a greater financial integration in the zone, although only in prices. On the contrary, a greater real integration of European financial markets remains pending.

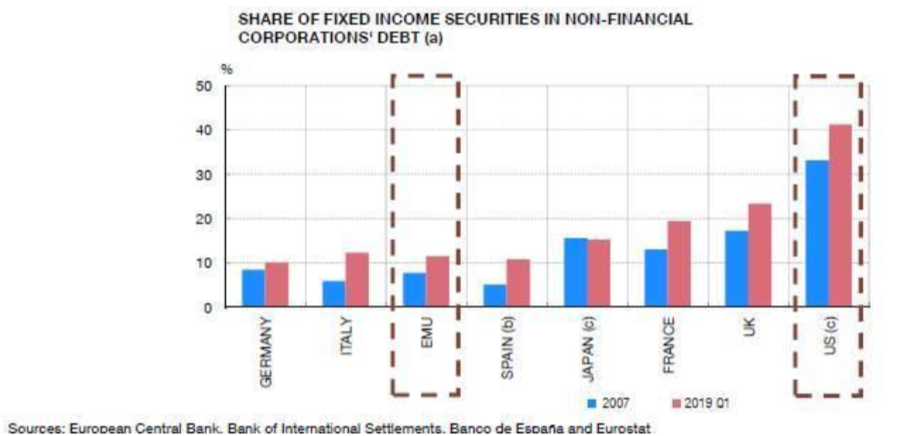

The large companies have benefitted from this improvement in market prices. A more demanding regulation of banks limiting the potential risk they can assume and the appearance of technological competitors not subject to the strict norms of credit entities have also contributed to this process.

Diversifying the sources of finance in the real economy is always desirable. Achieving an integrated capital market is a priority. But questions about the current process remain unanswered, from the necessary information and supervision which facilitate the management of risk in non-banking finance to the prevention of potential risks by supervisory authorities.

The transmission of favourable financial conditions remain banking: more than 60% of the European economy consists of SMEs which also account for 70% of employment. Banking activity lies in the stable relation in the medium and long term with its clients, which supposes a guarantee of stability in financing facing the weakness supposed by financial markets constantly recognised by the authorities.