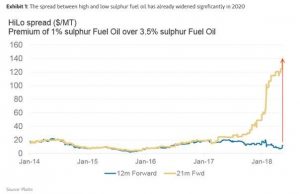

On the other hand, the changes we are making today in our estimates for oil prices are based to a large extent on one main factor: the new regulation for maritime transport (maritime transport accounts for 5% of global demand but generates 40% of all sulphur emissions). This means the increase in demand will be mainly focused on the distilled product and refining margins will improve. The best-placed refineries are: Repsol, Tupras, Reliance and Valero.

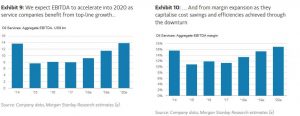

At this point in the cycle we prefer to have exposure to oil services companies than to integrated ones, given the rise in crude prices and the improvement in end markets. We expect multiples to expand and forecasts to increase to enter a sweet spot in the cycle. In 2018, the sector has risen 13% in the year to date compared with 79% in 2006/07 when the cycle also had similar characteristics. In the highlighted graphics we can see how sentiment remains depressed and the sector has performed worse than crude and the integrated companies. That said, we expect Ebitda growth to accelerate from now to 2020, thanks to the capitalisation on the cost and efficiency savings obtained during the crisis. The companies we would buy are: Tenaris, TechnipFMC, PGS, Hunting, Saipem CGG and Vallourec.