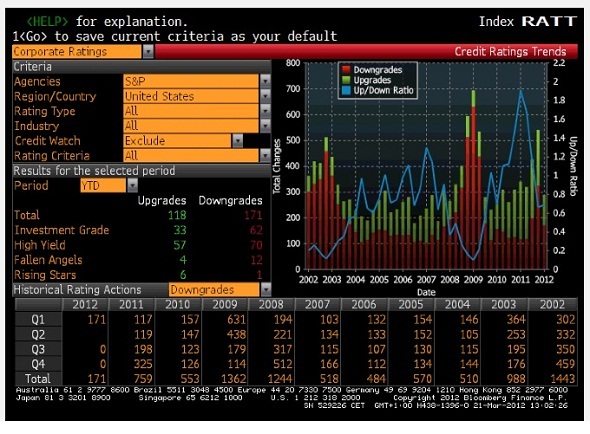

Ouch. The US corporate sector accumulates 171 credit downgrades in the first quarter, the highest since the 2009. In the balance of revisions (upward/downward), the ratio is 0.69, far from the highs of 2011 when for each rating cut down there were two ratings changing upwards. In the sectoral breakdown, three areas stand out as having a low rate of upward/downward revisions: telecommunications, financials and non-cyclical consumption. In the opposite side, the market areas that accumulate more relative number of upward revisions in credit ratings are natural resources, technology and cyclical consumption.

Analysts at AFI say that the slowdown in the profit cycle and doubts on the ability to maintain business margins at record highs (more than 10% of GDP), are some of the arguments for the recent acceleration in downward revisions.

With regard to the cyclical slowdown in profits, EPS growth estimates for 2011 had gone from 20% to 16%, and in 2012 from 14% to 10%. Furthermore, the role of fiscal deficits in the composition of the current business margins in the US suggests a profits cycle vulnerable to the upcoming fiscal consolidation.

“Yet, the fall in spreads in the secondary market and the strong primary market activity (between the European and the US corporate world there has been an issuance of $300 billion so far in 2012) does not suggest that investment funds are overly concerned about the deterioration of credit ratings and the vulnerability of the profit cycle. The liquidity created by central banks is leading the market.”

Be the first to comment on "Thursday’s US Corp graph: downgrades hike"