Tiffany Wilding and Nicola Mai (PIMCO) | European measures applied to mitigate the effects of the pandemic have contained the unemployment rate in Europe more than in the U.S. While recognizing economic risks from the rising number of COVID-19 cases in the U.S., our forecast sees this success ratio reversing before the end of the year.

U.S. and European labor markets have displayed strikingly different performance during the crisis. From February to April, the Euro area unemployment rate rose only 10 basis points (bps) to 7.3%, while the U.S. rate (U3) rose 1,120 bps to 14.7% (Figure 1). Since then, the gap between the two regions has tightened, but remained wide overall: the U.S. unemployment rate dipped to 11.1% by June, while the Euro area unemployment rate increased slightly to 7.4% in May (latest data available).

Some attribute Europe’s employment resiliency to the region’s higher labor market inflexibility. Normally seen as a weakness, the more stringent hiring and firing regulation could be an advantage now as it is limiting job losses. However, we believe that the difference mostly stems from the different approach chosen by policymakers to support household incomes during the crisis: While the U.S. has focused on unemployment benefits, Europe has prioritized job protection through short-time work schemes (STWs), by which governments pay a portion of employees’ salaries (ranging from 60% to 85%) as their work time is reduced. In short, the U.S. has paid the unemployed to let the market run its course, while Europe has fought market forces by subsidizing companies. Which one is better?

Based on the unemployment data alone, Europe’s response looks more effective. However, direct comparisons are challenging. For example, within the U.S., many currently unemployed workers expect to return to their previous employer, and recent research suggests that worker expectations are strongly predictive of rehiring probabilities. This suggests that although the U.S. official unemployment rose more than in the EU, it could also fall more quickly, as the acute stage of the crisis passes. Furthermore, Europe’s STW schemes are expensive and several countries are planning to reduce their generosity through the course of the year, raising questions about their long-term success.

Potential unemployment

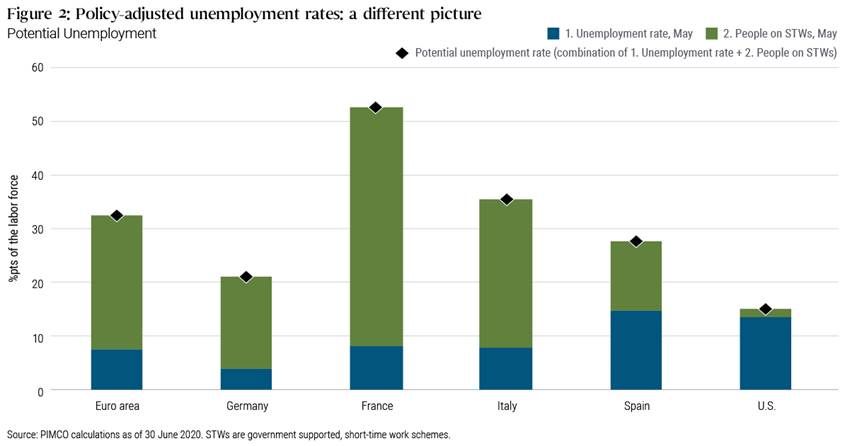

This has led us to create a “potential unemployment rate,” or an STW-adjusted European unemployment gauge that counts the STW population as unemployed. We acknowledge that this assumption is extreme but, at least, the measure offers a sense of what potential unemployment could be when these short-term support programs end. As of May (when unemployment data are available for both regions), Europe’s STWs population represented as much as 17% of the labor force in Germany1, 45% in France, 28% in Italy and 13% in Spain (25% on average for the Euro area’s major four countries). Using this policy-adjusted measure, we see in Figure 2 that Europe’s unemployment rate amounted to 33% in May, versus around 15% in the U.S.2

The key question in Europe ahead is how many people on these STW schemes will ultimately shift into unemployment. We assume a portion of them will (one in six according to our forecast), in response to the structural changes imposed by the crisis – sectors like travel, tourism, leisure and hospitality may take a long time to recover pre-crisis levels, if they do at all. At the same time, while recognizing risks from the recent acceleration in COVID-19 contagions in the U.S., we would argue that the more flexible and less friction-prone U.S. labor market could end up doing better than the European one in an environment of structural change.

When assessing risks for Europe, we would also note that the reduction in hours worked has been steeper: -3.1% quarter-on-quarter in Q1, vs -0.7% in the U.S. This speaks to the lesser demand for Europe’s labor, signaling a weaker employment outlook ahead.

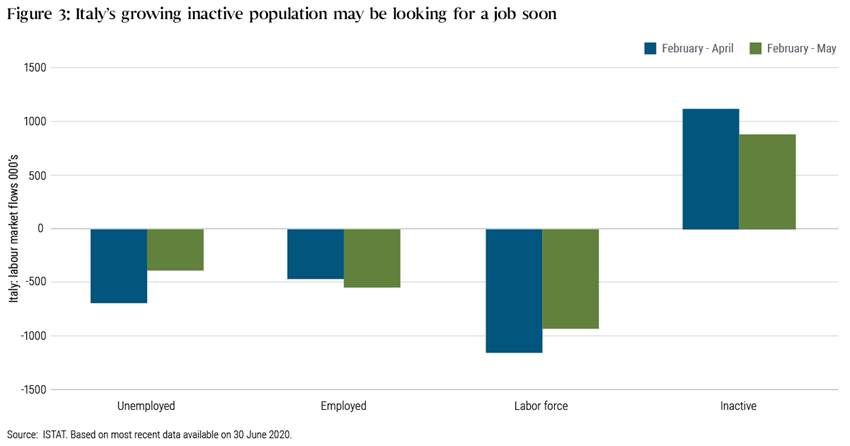

Finally, Italy poses a specific risk for European unemployment: At 7.8%, the Italian unemployment rate in May was 120 bps below its level in February. However, this improvement came entirely from people falling out of the labor force because of mobility restrictions, family duties and general caution. As seen in Figure 3, more than 1 million people moved into the “inactive” bucket from February to April. Some of these started to shift into unemployment in May, with more likely to follow. Another factor limiting the fall in employment in Italy has been a government ban on permanent employee layoffs that is due to expire around the middle of August. As the ban is lifted or eased, the potential for higher unemployment will rise.

Virus risks aside, the unemployment rate in Europe and the U.S. will be driven by how willing and able policymakers are to keep the support measures in place, how many companies remain viable, how deep the structural changes are, and how adaptable each country will prove. According to our current forecast, the recent relative underperformance of the U.S. labor market is not here to stay; we project the U.S. unemployment rate will fall to around 9% by year end, while Europe’s will rise to around 11% over the same period.

Risks from differential COVID-19 developments in the U.S. and in Europe

Uncertainty around our baseline forecasts has risen in response to recent, divergent COVID-19 developments in the U.S. and in Europe. While Europe so far has managed to keep contagion in check, there has been a significant spike in COVID-19 cases in several U.S. states representing around 40% of the U.S. economy – something that could challenge our projections.

Another challenge could come from the recent change in consumer behavior that we have observed in the U.S.: Over the last few weeks, business revenues and consumer spending have started to decelerate, especially in the areas suffering from the most acute outbreaks. This may increase the need for further fiscal and monetary accommodation, and will impact the direction of the U.S. unemployment rate.