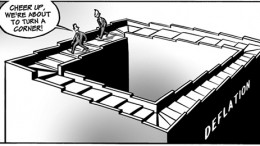

Deflation can be “good” or “bad”, it depends

SAO PAULO | By Marcus Nunes | I do not want to question the likely bad effects that come about owing to a large unexpected deflation (or inflation). What I want to question is whether a period of prolonged moderate (and presumably expected) deflation is necessarily associated with periods of depressed economic activity. Most people certainly seem to think so. But why?