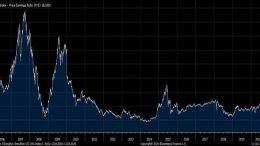

There Are Good Reasons For The Strong Ongoing Rally In Chinese Equities

Mobin Tahir (Wisdom Tree) | The S&P China 500 Index is up 17.7% and the CSI 300 Index is up 16.8% year-to-date.Breakneck gains in stock markets create excitement, but also raise fears of bubbles. There are good reasons for the strong ongoing rally in Chinese equities, and – although risks lurk on the horizon – we aren’t in bubble territory.