Do equities and bonds live on different planets?

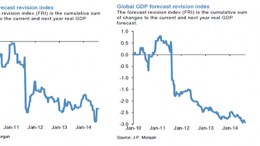

MADRID | The Corner | While bonds are considering a world without growth nor inflation, equities seem much more optimistic. On their Monday comment, JPMorgan analysts point out that, on a global level, monetary policies are still increasingly more expansionary in aggregate form.