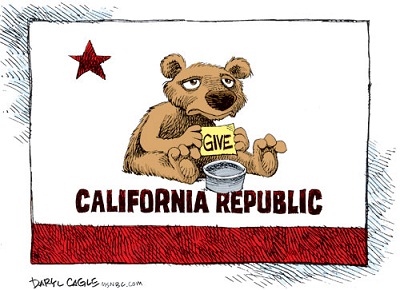

NEW YORK | California's new fiscal year begins July 1 with a massive problem: a $16 billion hole, the biggest deficit of the 50 states. Without one budget in place, the Golden State would not be able to make certain payments to schools or pay salaries of officials and their staff. While part of Europe suffers from austerity, California's lawmakers are also facing tough negotiations on how to eliminate the red ink and how deep the cuts should be.

NEW YORK | California's new fiscal year begins July 1 with a massive problem: a $16 billion hole, the biggest deficit of the 50 states. Without one budget in place, the Golden State would not be able to make certain payments to schools or pay salaries of officials and their staff. While part of Europe suffers from austerity, California's lawmakers are also facing tough negotiations on how to eliminate the red ink and how deep the cuts should be.

State Governor Jerry Brown, a democrat, wants a deep welfare reform and a larger reserve to help pull the state out of its projected deficit. His plan projects to raise the sales tax by a quarter cent and increase income taxes for people who make more than $250,000 a year, and collect $8.5 billion through mid-2013.

But democrats refuse to make deeper cuts to CalWORKS, the welfare-to-work program, and other social services for the poor. Both Brown's plan and the Democrats' assume voters will approve the governor's tax initiative in November. Should they reject it, schools and other public entities would suffer severe automatic budget cuts. Dozens of demonstrations have taken place in different cities so far.

According to a recent Standard & Poors report, California's budget dilemma is nothing new. Actually they wonder whether the State has ever had a genuinely balanced budget in the past decade. The problem is that lawmakers have responded to the weak revenue environment with “aggressiv

e spending reductions.”

“California revenue system has structural problems, but the urgency of its budget and cash situation necessitate that policymakers should focus on making spending cuts,” the rating agency says.

There is a long-term source of credit pressure coming from retirement liabilities that in S&P's view have contributed little if anything to California’s current budget problems.

“Spending and taxes relative to the State's economy also do not appear to be causing the recent fiscal imbalance when viewed over the past several decades. Instead, we find that revenue generated by the State's tax system has been growing at a slower rate in recent decades while becoming more volatile.”

S&P points out that California has a strong capacity to repay its debt according to its terms, reflected in their 'A-' general obligation bond rating.

However, its budgetary performance is weak because of a “dysfunctional” tax structure that hasn’t kept up with changes in California’s economy that have made it more dependent on services rather than retail sales. For S&P, California's tax revenue system is outdated, volatile and insufficient for California's current level of spending.

S&P thinks governor Brown's tax initiative could ultimately benefit California's credit quality.

“If no reforms were undertaken during this period, the underlying deficit would presumably reemerge once the temporary tax rates expire. Under this scenario, we believe any general fund relief derived from the temporary tax increase could wind up being a missed opportunity.”