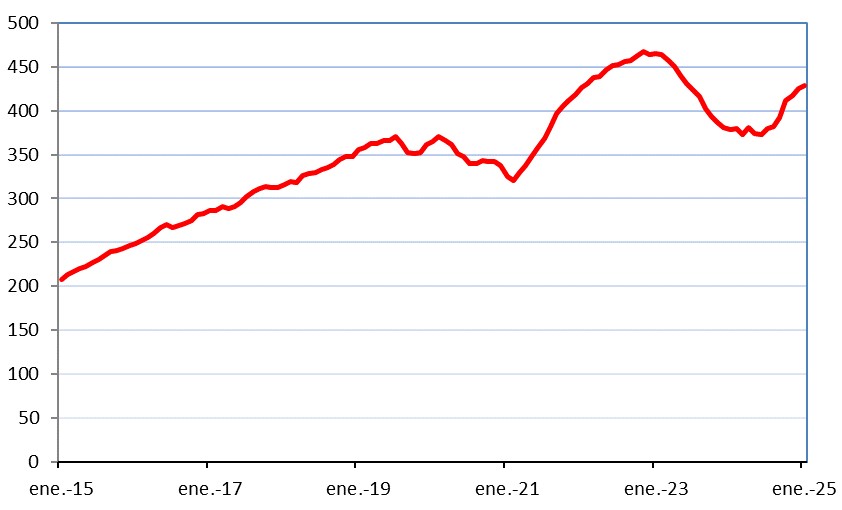

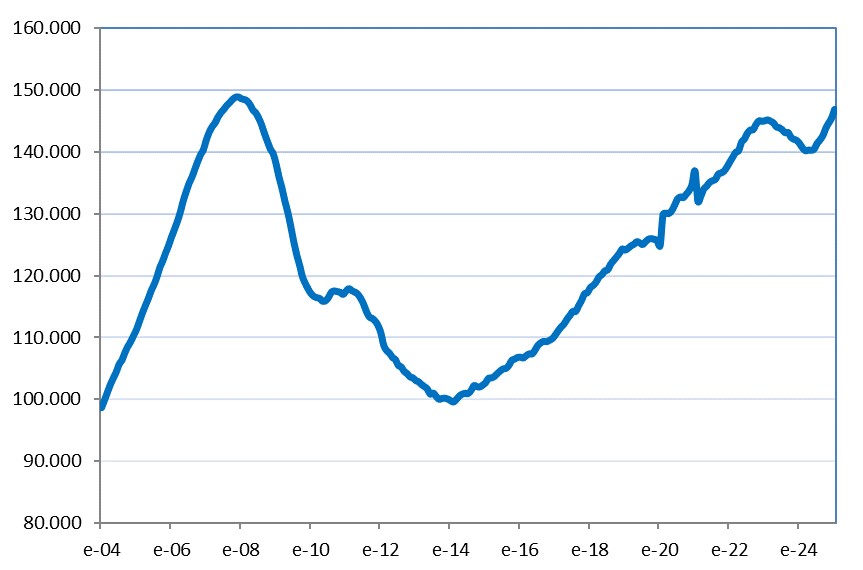

Santiago Martínez Morando (Ibercaja) | The strong growth of the mortgage market experienced in the second half of 2024 continued in January: the number of mortgages granted grew by 11.0% year-on-year, the average amount per mortgage by 10.2% and the total amount granted by 24.3%. In twelve months, 429,000 mortgages were granted for an average value of €146,835 and a total amount of €62,948 million.

Number of mortgages granted in 12 months:

Average amount:

Credit for home purchases is benefitting from the expansion of demand due to demographic reasons and the moderation of interest rates (the average interest rate in January was 3.08% according to the INE, when it had ended 2024 at 3.25%). The main risk for the sector continues to be the sharp rise in prices, which makes housing less accessible, especially in the most strained areas. However, this sharp rise in prices could be causing purchases to be brought forward in anticipation of the shortage of housing supply continuing to put upward pressure on housing prices in the coming quarters.