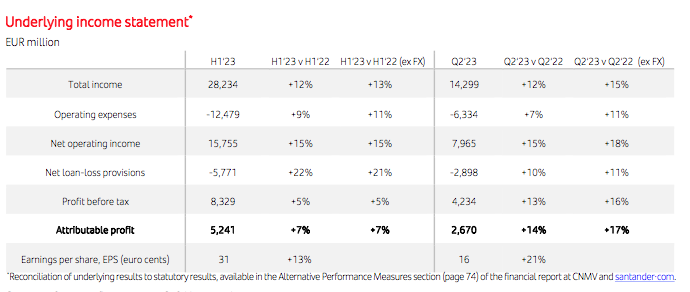

Santander achieved an attributable profit of €5,241 million in the first half of 2023, up 7% in both constant and current euros versus the same period last year, as strong growth in revenues, particularly in Europe, offset the year-on-year growth in provisions in North and South America. In the second quarter, attributable profit increased 17% versus the second quarter of 2022 to €2,670 million, as the number of customers the group serves grew nine million year-on-year, taking the total to 164 million.

The strength of the results was reflected in growing profitability and shareholder value, with a return on tangible equity (RoTE) of 14.5% (+80 basis points); earnings per share (EPS) of 31 euro cents, up 13%; and tangible net asset value (TNAV) per share on 30th June at €4.57.

Including the cash dividends paid against 2022, TNAV per share plus cash dividend per share was 11% higher year-on-year. In the first six months of the year, the value created for shareholders (TNAV + cash dividend) is equivalent to more than €6 billion.

Total loans were flat, with consumer lending up 8%. Customer funds grew 4% to €1.13 trillion, with deposits up 4%, supported by both individuals and Corporate and Investment Banking (Santander CIB).

Customers continued to utilize excess deposits to pay down debt in the quarter, particularly mortgages.

In total, income increased 13% to €28,234 million. The increase in both customer activity and interest rates supported a 15% increase in net interest income, with growth in all regions and particularly strong growth in Europe (+32%). Net fee income was up 5% by sales of high value products – particularly within the bank’s global businesses (CIB, Wealth Management & Insurance, PagoNxt and the auto finance business), which together represent 42% of net fee income. Net interest income and net fee income accounted for 96% of the group’s total income.

While inflationary pressure led to an 11% increase in cost, the efficiency ratio improved by 1.3 percentage points year-on-year to 44.2%, as the bank continued to improve productivity and reduce costs in real terms (-1%).

Loan-loss provisions were up 21% year-on-year and flat quarter-on-quarter. The year-on-year increase was due primarily to the post pandemic normalisation in the US as well as an increase in Brazil and additional provisions to cover the Swiss franc mortgage portfolio in Poland.

Provisions in the US fell in the second quarter relative to the first quarter. Overall credit quality remained robust, with cost of risk lower than target for the year at 1.08%. The non- performing loan (NPL) ratio stood stable at 3.07%.

At the end of the second quarter, the group liquidity coverage ratio (LCR), which measures liquid assets versus expected short-term cash outflows in a stress scenario, was 158%. As of June 2023, the liquidity buffer, comprising high quality liquid assets (HQLAs), exceeded €300 billion, of which more than €200 billion was in cash, equivalent to 20% of the bank’s deposit base.

Approximately 80% of deposits from individuals are insured with deposit guarantee schemes.

The bank’s fully-loaded CET capital ratio stood at 12.2%, ahead of the group’s capital target, as strong gross organic capital generation (+21 basis points) offset accruals for future cash dividend payments against 2023 results and the cost of the acquisition of the outstanding minorities in Santander Mexico.

Banco Santander’s annual general meeting (AGM) approved a final cash dividend for 2022 of 5.95 euro cents per share, paid in May 2023, meaning the total cash dividend charged to 2022 was up 18% versus the previous year at 11.78 euro cents per share. The bank also completed two share buyback programmes against 2022 earnings for a total amount of €1.9 billion. Since November 2021, Santander has bought back 7% of its outstanding shares.

Including cash dividends and share buybacks, the total shareholder remuneration against 2022 came to €3,842 million, representing approximately 40% of group underlying profit in 2022 and an equivalent yield of over 8%. The board has approved a new shareholder remuneration policy, increasing the payout ratio from 40% to 50% of group attributable profit in 2023.

Ana Botín, Banco Santander executive chair, said: “We are making excellent progress against our strategic objectives of simplifying our business and leveraging the strength of our global network. Our results reflect that progress, with nine million customers joining us in the past twelve months, resulting in double-digit revenue growth. Credit quality remains robust, and we continue to deliver improved profitability with return on tangible equity reaching 14.5%, and consistent organic capital generation with capital above our 12% target. Because of this strong performance we are creating value for shareholders, with TNAV plus cash dividend per share up 11% year-on-year, and we are well on track to meet all our 2023 targets.”