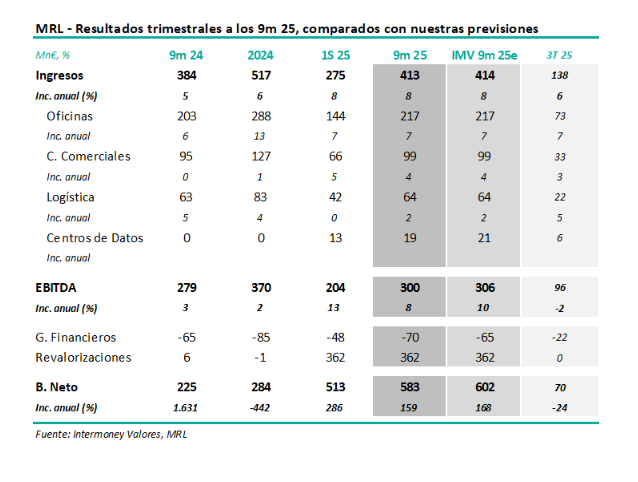

Intermoney | The REIT (Buy, PO €15) has just announced its results for September. The main figures from the results, together with our estimates, are shown in the attached table. Revenue/income for 9M25 rose 8% to €413 million, broadly in line with Intermoney’s estimate (€414 million), while EBITDA (€300 million, up 8%) was slightly below our figures (10%), following higher-than-expected overheads, particularly in personnel and the LP incentive plan.

By asset type, offices stood out with rental growth of 7% as items previously considered ‘other’ were incorporated, while data centres (rental income of €19 million) confirmed their strong growth in H1. There were hardly any changes in the revaluation figure during Q3 (€362 million in 9M), an item that we do not estimate as a matter of policy. The net figure, €583 million compared to €225 million at 24 September, was also slightly below the Intermoney estimate, €602 million, mainly due to higher financial items.

We are not changing our EBITDA estimates for 2025-2027, which we increased by 4-5% in our September note; we then considered Phase II of the data centres (246 MW), which implied forecast increases of 30% from 2028.