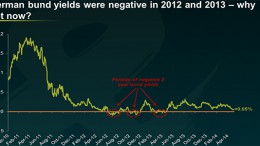

After ECB’s bazooka, will we see negative bund yields again?

MADRID | By Ana Fuentes | Now that the ECB will charge banks for keeping them their money, don’t be surprised if some short-dated core sovereign bonds start yielding negative, Bond Vigilantes remark. Actually we’ve seen that before in the EZ: in August 2012, German authorities received with open arms 750 billion euros in deposits of its eurozone neighbors, mainly Spaniards and Italians. That intense demand drove the prices of short dated bunds to levels which produced negative yields.