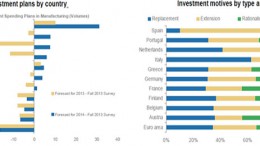

Spanish businessmen are the eurozone’s most investment-friendly

MADRID| By The Corner | Spain is to lead the EU economic recovery until 2018, according to Morgan Stanley. External sector, capital spending and internal demand would be the factors pushing the country’s growth. Regarding capex, Spanish businesses are the most inclined to rise their investment expenditure in manufacturing during year 2014 in order to boost production capacity.