Articles by The Corner

About the Author

Raising tariffs on cars imported into the US from Europe could force changes in production plants

A posible rise in the tariffs on cars imported into the US from Europe could reduce the profitability of the main carmakers in the European region and force executives to change the the production plants of certain models of vehicles, a report by S&P points out.

ECB reaching out for banks

Axel Botte (Ostrum AM) | Equity markets resumed rising last week. European indices gained as much as 2.5%. The rebound in bank stocks appears traceable to Mario Draghi’s comments hinting at possible changes to the deposit facility rate scheme. Equity markets were also upbeat in Asia and in North America.

TCI sells 0.8% of AENA

Banc Sabadell | The regulator has announced that TCI will make an accelerated sale of 0.8% of AENA at an estimated price (according to Bloomberg) of 159.53 Euros/share (-2.2%).

ECB calls attention to the evolution of Spain’s “excessive” fiscal deficit

Bankinter | The ECB has called attention to the evolution of Spain’s fiscal deficit in its Annual Report for 2018, published this week. The impact on the country’s risk premium, currently around 120 b.p. (IRR 1.12%/1.14%), will probably be negative.

ACS confirms “significant” dividend increase: 37% over 2018

Bankinter | The company has announced that it will share 1.44 euros gross per share as a complementary dividend. This means that the total dividend for the year will be 1.89 euros/share (+37% over the previous year).

Will we see a modest recovery of the euro?

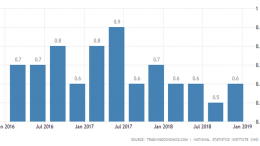

The inflation data for March will be the key publication of this week. With the market discounting a 0.1% drop in the main figure, Ebury analysts believe that a 1% inflation would be enough to drive a modest rebound in the euro from its current position.

Spain will grow 2.1% in 2019 leading Eurozone’s growth (S&P)

S&P has reduced its estimate of GDP for the euro area by 5 tenths in 2019 from +1.6% in November to +1.1%. In 2020 it forecasts a growth of +1.4% (vs. +1.6% previous), +1.4% also in 2021 (vs +1.5% previous) and +1.3% in 2022.

European banks could reduce the bill of 7 billion euros for the excess cash in the ECB deposit account

Intermoney | The president of the ECB opened the door to further stimulus if the economic and inflation perspectives in the Eurozone remain low, in the shadow of a scenario dominated by downside risks for activity. In fact, he recalled that “there is no lack of instruments” to fulfill his mandate, at the same time as he is contemplating new delays in raising interest rates. Textually he said: “we are assured that monetary policy continues to accompany the economy, adjusting our orientation on interest rates to reflect the new inflation perspectives”.

A snapshot of the Greek economy

Dimitris Smyrnakis via Macropolis | Following January’s five-year bond issuance, which raised 2.5 billion, along with Moody’s upgrading the country’s sovereign credit rating to B3 from B1 and Fitch’s confirming its own rating at BB-, last Tuesday Greece issued its first 10-year bond since the country entered the debt crisis nine years ago.